hangofranking.ru

Tools

What Is The Quietest Keyboard

Vendors and Products · Jelly Comb MK08 [Whisper Quiet] Ultra Compact Wireless Keyboard · Logitech MK · Kensington Pro Fit Ergonomic Wireless Keyboard. Shop Target for quiet keyboard logitech you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on. #8 Pick: Cherry MX Silent Red/Black The Cherry MX Silent switches are linear with a mm total travel distance. They are slightly quieter than the other. The best option for a quiet keyboard is a linear switch and maybe tactile. Linear: Smooth and consistent keystroke with a quiet noise. Tactile: A small bump. Gateron Silent Switches are one of the quietest keyboard switches on the market. If you are looking for a good and reliable silent switch, the Gateron silent. Gateron Milkyyellow Switches - Smooth And Quiet Linear 5 Pin MX Mechanical Keyboard Switches For Gaming · Gateron Milkyyellow Switches - Smooth And Quiet Linear. Logitech MK Wireless Mouse & Keyboard Combo with SilentTouch Technology, Full Numpad, Advanced Optical Tracking, Lag-Free Wireless, 90% Less Noise - Graphite. The Best Quiet Gaming Keyboards in · Varmil Minilo 75% Mechnanical Keyboard Varmilo Minilo 75 Mechanical Keyboard · SteelSeries Apex Pro · best gaming. If you're looking at Cherry MX switches only, Silent Red are the quietest. Those are quite hard to find. Here is a list from quietest to loudest. Vendors and Products · Jelly Comb MK08 [Whisper Quiet] Ultra Compact Wireless Keyboard · Logitech MK · Kensington Pro Fit Ergonomic Wireless Keyboard. Shop Target for quiet keyboard logitech you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on. #8 Pick: Cherry MX Silent Red/Black The Cherry MX Silent switches are linear with a mm total travel distance. They are slightly quieter than the other. The best option for a quiet keyboard is a linear switch and maybe tactile. Linear: Smooth and consistent keystroke with a quiet noise. Tactile: A small bump. Gateron Silent Switches are one of the quietest keyboard switches on the market. If you are looking for a good and reliable silent switch, the Gateron silent. Gateron Milkyyellow Switches - Smooth And Quiet Linear 5 Pin MX Mechanical Keyboard Switches For Gaming · Gateron Milkyyellow Switches - Smooth And Quiet Linear. Logitech MK Wireless Mouse & Keyboard Combo with SilentTouch Technology, Full Numpad, Advanced Optical Tracking, Lag-Free Wireless, 90% Less Noise - Graphite. The Best Quiet Gaming Keyboards in · Varmil Minilo 75% Mechnanical Keyboard Varmilo Minilo 75 Mechanical Keyboard · SteelSeries Apex Pro · best gaming. If you're looking at Cherry MX switches only, Silent Red are the quietest. Those are quite hard to find. Here is a list from quietest to loudest.

Cherry MX Reds are the quietest mechanical switches. They're meant for gamers that want quick, easy actuation. So there's little to no tactile feedback. lilpielol on July 16, "the quietest keyboard i wanted to change my switches but had 2 options. either clicky or silent. and that is. Haimu heartbeat linear switches are pretty dang quiet, but depending on the board or the keycaps or even the stabs for longer keys there will be some residual. #1 Pick: Durock Silent Linears. Durock Silent Linears are available in 2 different colors. Both are linear switches that are super smooth and super quiet. Gateron Silent Switches are one of the quietest keyboard switches on the market. If you are looking for a good and reliable silent switch, the Gateron silent. If you're looking at Cherry MX switches only, Silent Red are the quietest. Those are quite hard to find. Here is a list from quietest to loudest. Buy Quiet Keyboard with 3 Multi Color LED Lighting Modes, Turbo Input Mode, Anti-Ghosting, 19 Key Roll Over, Slim Low Profile Metal Design at hangofranking.ru Best Quiet Gaming Keyboards · Amazon Basics Low-Profile Wired USB Keyboard · SteelSeries Apex Pro HyperMagnetic · Logitech G Mechanical Gaming Keyboard. Red color is the quietest mechanical keyboard switch in Black, Brown, Blue and Red. It is required by computer game in controling. SteelSeries APEX 3 Water Resistant Whisper Quiet Keyboard with RGB LightingIP32 water resistant for protection against spillsCustomizable zone RGB. "quiet keyboard" · Logitech - MX Mechanical Full size Wireless Mechanical Tactile Switch Keyboard for Windows/macOS with Backlit Keys - Graphite · Logitech -. The Best Quiet Gaming Keyboards in · Varmil Minilo 75% Mechnanical Keyboard Varmilo Minilo 75 Mechanical Keyboard · SteelSeries Apex Pro · best gaming. Higround's most quiet keyboard. A collaboration celebrating the merging of women's streetwear and gaming. Our signature 65% keyboard (dedicated arrow keys). Shop Target for quiet keyboard logitech you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on. Matias Quiet Click switches are first mechanical keyswitches that are actually quiet. They let you build superior mechanical keyboards that are no louder than. Best Buy customers often prefer the following products when searching for quiet keyboards. · Insignia™ - Key Bluetooth Scissor Switch Number Keypad for. Mechanical keyboards can use silent switches, making them completely silent. The world's quietest keyboard is the Opal 65 with silent glacier switches. The. 7 Best Quiet Mechanical Keyboards · 1. HyperX Alloy Core RGB · 2. The Corsair K95 RGB Platinum XT · 3. Redragon K SURARA RGB LED Backlit Mechanical Gaming. Bluetooth and GHz wireless; Controls up to four devices; Extremely comfortable for fast typing; As quiet as a mechanical keyboard gets; Bright backlight. Top 7 Best Quiet Keyboards · HyperX Alloy - Our Choice · Redragon K Shiva - Ergonomic · SteelSeries Apex 3 - Multimedia controls · Corsair K55 - For gaming.

Pay Yourself First Calculator

Get our new “Pay Yourself Calculator” so you can finally pay the CEO and most important employee in your business more. Alternatively, try making saving automatic by paying yourself first. Set up an automatic draft from your checking account to your savings account or other. This calculator uses the 50/30/20 budget to suggest how much of your monthly income to allocate to needs, wants and savings. Use this calculator and find out how to pay yourself first by setting aside a portion of your earnings, in a tax deferred retirement account. Golden rule of personal finance: Pay Yourself First. Prioritize saving & investing with the 50 30 20 rule for a budget plan that accounts for your money. Family Size, including Yourself. Living OCONUS or Not Receiving BAH. Yes No. Calculate. DISCLAIMER: This calculator is provided for informational purposes only. Our free budget calculator based on income will help you see how your budget compares to other people in your area. Find out how your budget compares. Learn about the pay yourself first budgeting strategy to reach your savings goals from Spruce banking app. Read more! The amount you pay yourself is invested monthly at the beginning of each month in a tax-deferred investment account. The rate of return is compounded monthly. Get our new “Pay Yourself Calculator” so you can finally pay the CEO and most important employee in your business more. Alternatively, try making saving automatic by paying yourself first. Set up an automatic draft from your checking account to your savings account or other. This calculator uses the 50/30/20 budget to suggest how much of your monthly income to allocate to needs, wants and savings. Use this calculator and find out how to pay yourself first by setting aside a portion of your earnings, in a tax deferred retirement account. Golden rule of personal finance: Pay Yourself First. Prioritize saving & investing with the 50 30 20 rule for a budget plan that accounts for your money. Family Size, including Yourself. Living OCONUS or Not Receiving BAH. Yes No. Calculate. DISCLAIMER: This calculator is provided for informational purposes only. Our free budget calculator based on income will help you see how your budget compares to other people in your area. Find out how your budget compares. Learn about the pay yourself first budgeting strategy to reach your savings goals from Spruce banking app. Read more! The amount you pay yourself is invested monthly at the beginning of each month in a tax-deferred investment account. The rate of return is compounded monthly.

Find out how the pay yourself first budgeting method can help you grow your savings on autopilot and reach your financial goals with minimal hassle. Ensure you're compensated fairly for your hard work with the 'Pay Yourself: A Salary Calculator for Business Owners'. This intuitive tool helps you. pay yourself first with Jen in the video below. Don't forget to check out Calculator below to get a clear picture on where you stand with your. 'Pay yourself first' is a reverse budgeting strategy where you first set aside money for savings, such as for retirement or an emergency savings fund. FREE DOWNLOAD. Pay Your First Calculator. Allocating your income (sales, gross revenue, total revenue, etc) into different buckets will ensure you pay. Calculators; Pay Yourself First. Pay Yourself First. Using borrowed money to finance the purchase of securities involves greater risk than purchasing using. pay yourself first by making deposits automatically each paycheck. Since many of us are paid every other week, this calculator shows how much you can save. How much should I pay myself? There are several ways that you can go about this. When we start talking about paying yourself from your own LLC, here's what to. Cost-of-Debt Calculator. Debt is expensive. This calculator shows you just how expensive. Find out how much you owe, the interest you'll pay, and. Enter you monthly Net Income ; This is your SAVINGS - what you pay yourself first $ ; This is your ESSENTIALS - Rent, mortgage, utilities $ ; This is for. Use this handy free calculator to see how much you can pay yourself, or follow this calculation in order. Savings Calculator – Use this tool to find out how much you can end up with by saving and investing your money over a given time period. Retirement Plans –. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage. Use the ADP Salary Paycheck Calculator to find your Net Pay (the wage you “Pay yourself first” by putting aside a percent of your net salary into a. A pay-yourself-first budget (sometimes referred to as a reverse budget) prioritizes goal-based saving categories like retirement and investments before. The Pay Yourself 1st Calculator for $37 (value $priceless) will give you the information you need to finally pay YOURSELF the most important employee in. Check out the background of investment professionals. Magnifying glass icon. It's a great first step toward protecting your money and it only. Pay yourself first. If you're like most Canadians, you have really good Cash Flow Calculator An essential tool for effective household budgeting. Tools for mortgages and loans. Mortgage payment calculator. Find out how much your mortgage payments will be. calculate mortgage payments. How much will my payments be? Calculate your monthly mortgage payment for a given purchase price, down payment, interest rate, and loan term.

Can You Board A Puppy At 12 Weeks

Additionally, if possible, try scheduling regular visits prior so that both you and your pet can get used to being apart without too much stress involved! After. The rabies vaccination cannot be administered younger than 12 weeks of age. This means your puppy would need to wait approx. 2 months before he can enter the. It's recommended you board your young one when they're at least four months old. The reason behind this is, during this period, your puppy should have completed. All dogs must be at least 12 weeks of age or older and fully vaccinated. you can be assured that your pup will be playing with fully vaccinated friends. However, most veterinarians and breeders would put the optimum age to bring home a puppy somewhere between 8-to weeks old. Here's why. Socialization Period. What age can I bring my Puppy? We recommend bringing puppies in that are at least 12 weeks of age or have had their first two sets of puppy distemper/parvo. A puppy must be at least 10 weeks old before attending doggy daycare or boarding. In addition, they need to receive a number of vaccinations. Before you bring. Obedience Dog Training. You can begin dog training as early as 12 weeks. Older dogs can be trained as well. The dog training will teach your dog useful. Puppies must be at least 10 weeks old before they can attend doggy daycare or a boarding facility. They also need to have a variety of shots. Additionally, if possible, try scheduling regular visits prior so that both you and your pet can get used to being apart without too much stress involved! After. The rabies vaccination cannot be administered younger than 12 weeks of age. This means your puppy would need to wait approx. 2 months before he can enter the. It's recommended you board your young one when they're at least four months old. The reason behind this is, during this period, your puppy should have completed. All dogs must be at least 12 weeks of age or older and fully vaccinated. you can be assured that your pup will be playing with fully vaccinated friends. However, most veterinarians and breeders would put the optimum age to bring home a puppy somewhere between 8-to weeks old. Here's why. Socialization Period. What age can I bring my Puppy? We recommend bringing puppies in that are at least 12 weeks of age or have had their first two sets of puppy distemper/parvo. A puppy must be at least 10 weeks old before attending doggy daycare or boarding. In addition, they need to receive a number of vaccinations. Before you bring. Obedience Dog Training. You can begin dog training as early as 12 weeks. Older dogs can be trained as well. The dog training will teach your dog useful. Puppies must be at least 10 weeks old before they can attend doggy daycare or a boarding facility. They also need to have a variety of shots.

luxury Daycare and Boarding services for dogs. We are open for can be with their puppy shots. We recommend dogs 12 weeks of age or older for group play. Obedience Dog Training. You can begin dog training as early as 12 weeks. Older dogs can be trained as well. The dog training will teach your dog useful. During the fifth week of clicker training which would start during the 11th week of the puppy's life we teach retrieve command to the place board. It's very. Are there any age requirements for my dog to be eligible for daycare or boarding services? Yes, your pup must be at least 12 weeks old. All dogs older than 1. At what age can I board my puppy? We offer boarding for puppies as young as 12 weeks old. While we sometimes make accommodations for younger puppies, we. We don't require that our boarding dogs be spayed or neutered. However, if you have multiple dogs, boarding in the same suite, they will need to be spayed/. Puppy Boarding: We do not recommend boarding puppies under 12 weeks old. However, we understand that life can sometimes throw the unexpected your way and it. National K-9 also does not board puppies under the age of 16 weeks or female dogs that are pregnant or in heat. Dogs with fleas or flea dirt will be treated at. When your puppy is at or over 12 weeks of age you will proceed to the Puppy Training Class after you've attended or viewed an Orientation. Orientation. The. If the puppy is 10 weeks, it hasn't received the full course of Parvo innoculations. This is a dangerous, deadly disease. You should make sure that the sitter. Be between 12 weeks - 12 years old; Be spayed/neutered if 9 months or older; Be up to date on Bordetella, DHPP, Leptospirosis, and Rabies vaccines; Have passed. For this reason, our minimum boarding age for dogs is 4 months. It is generally recommended that puppies get their first round of “adult” shots at 12 weeks . For this reason, our minimum boarding age for dogs is 4 months. It is generally recommended that puppies get their first round of “adult” shots at 12 weeks . Puppies must be at least 10 weeks old for a day board or daycare, and 12 weeks old for an overnight stay. If someone other than yourself will be picking up. Puppies need to meet people, prior to 12 weeks of age! Due to their vaccination needs, this can be quite difficult! Enroll your puppy into our carefully. Perhaps you already have a week vacation planned and need dog boarding week add-on will be $ Puppies weeks. Our Positively Perfect puppy. When it comes to puppies we do require that they are at least 9 weeks of age and have had their first 2 rounds of Parvo vaccinations. For kittens, we require. Our 2-Week Puppy Board & Train is for puppies between 12 weeks and 5 months of age. At the end of the 2 weeks, we will meet up for a couple hours so we can. If kept on a schedule, this means your puppy should be at least 14 weeks of age to have received all the necessary vaccinations (Rabies, DHLPP/DHPP and.

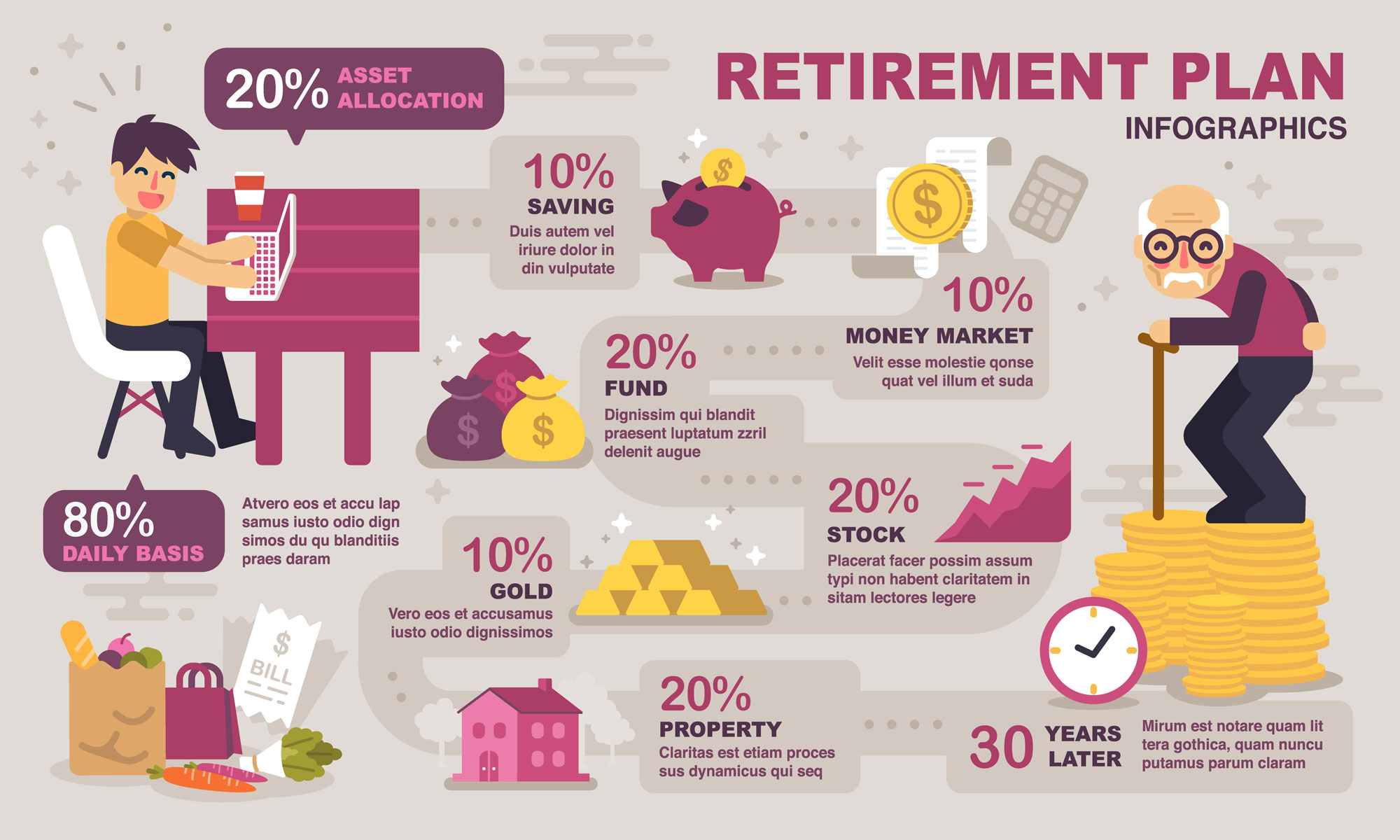

Information Needed For Retirement Planning

Retirement plan · Date of membership · Total credited service · Contribution and loan balances · Employment and salary data · Projection of pension benefits . Because you are likely to spend 20 or more years in retirement, you may need help making financial decisions as you age. Information Quality Guidelines. Determine your desired retirement lifestyle and timeline · Determine retirement spending needs · Take healthcare expenses into consideration · Start planning as. Finances · Collect and review applicable information and forms, if necessary, for retirement plan distribution. · Review your most recent pay stub or advice slip. Receive a personalized retirement action plan with savings and investment recommendations. Start now. Retirement planning resources · Choosing your retirement benefits · Staying on track for a secure financial future · When you're ready (or almost ready) to retire. Prepare a budget for your expenses in retirement. In retirement, you'll likely spend less on payroll taxes, income taxes, and your work wardrobe. But you might. It's good to start thinking about your retirement options, and the choices you'll need to make, a few years in advance of when you stop working. Seven factors to consider to help you make an informed decision about when to apply for retirement benefits based on your personal situation. Retirement plan · Date of membership · Total credited service · Contribution and loan balances · Employment and salary data · Projection of pension benefits . Because you are likely to spend 20 or more years in retirement, you may need help making financial decisions as you age. Information Quality Guidelines. Determine your desired retirement lifestyle and timeline · Determine retirement spending needs · Take healthcare expenses into consideration · Start planning as. Finances · Collect and review applicable information and forms, if necessary, for retirement plan distribution. · Review your most recent pay stub or advice slip. Receive a personalized retirement action plan with savings and investment recommendations. Start now. Retirement planning resources · Choosing your retirement benefits · Staying on track for a secure financial future · When you're ready (or almost ready) to retire. Prepare a budget for your expenses in retirement. In retirement, you'll likely spend less on payroll taxes, income taxes, and your work wardrobe. But you might. It's good to start thinking about your retirement options, and the choices you'll need to make, a few years in advance of when you stop working. Seven factors to consider to help you make an informed decision about when to apply for retirement benefits based on your personal situation.

Now that you have your first benefit payment has been issued, you have all the information you need in ORBIT. ORBIT will provide you with payment history. The rest of your retirement funds likely will need to come from your wages, account-based retirement plan savings and investment accounts and any wages earned. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at When considering your retirement lifestyle, a common guideline is to replace 70% of your annual income before your retirement. You can plan to do this through a. Use this retirement planning checklist with guidelines starting 10 years out to help you more efficiently prepare for the next phase of your life. 1. Add details to your goals · 2. Catch up if you need to · 3. Consider consolidating retirement accounts · 4. Plan for health care expenses · 5. Start planning for. Retirement PlanningAs you near retirement, you'll have questions and need information. This website will help guide you from your initial thoughts to t. Get tax information for retirement plans: required minimum distribution, contribution limits, plan types and reporting requirements for plan administrators. Planning for Retirement · Review retirement options (pdf) · Attend benefits presentation. TRS counselor will provide information you need to know about your. Each of the ten modules provides information that can be valuable in answering the questions you need to consider as you make your plans. The modules include. Remember to review your financial plans at least once a year to see if you need to make changes to stay on track for a secure retirement. Don't touch your. Key Takeaways · Retirement planning should include determining time horizons, estimating expenses, calculating required after-tax returns, assessing risk. Here's a year, year-by-year checklist suggesting when to handle different parts of your financial plan as you approach the retirement finish line. Life Expectancy. Learn about the likelihood of you reaching a milestone birthday and understand how long your retirement savings should last you. Updated annually, the Guide to Retirement provides an effective framework for supporting your retirement planning conversations with clients. This checklist can help you successfully transition into retirement. You might be able to increase your retirement income or even retire sooner than you had. Now that you have your first benefit payment has been issued, you have all the information you need in ORBIT. ORBIT will provide you with payment history. Experts tell us you will need at least 70 percent of your pre-retirement income to enjoy the same standard of living once you stop working. A Tier 4 member for. Each of the ten modules provides information that can be valuable in answering the questions you need to consider as you make your plans. The modules include. There's also a Retirement Planning Checklist on our website. You should become familiar with the information needed to apply for retirement in our publication.

What Is The Cost Of An Iphone 13

I've always been eager to try an iPhone, and I'm considering switching from my current phone. Since the iPhone is still a relatively expensive. iPhone 15 ProiPhone 15iPhone 14iPhone 13iPhone SEiPhone 12AirPodsAirTagCell Celebrate with tons of super-low prices. Shop now. Restored Apple iPhone. Retail price: $ One-time activation fee of $ Device unlocking policy. Or, choose. iPhone Your new superpower. · Hearing Aid. M3/T4 · OS. iOS · Network. 5G LTE/Wi-Fi · Display. inch Super Retina XDR OLED, HDR10, Dolby Vision display. Apple iPhone 13 (Certified Pre-Owned). Starts at $0/mo. price is not offering Looking for Verizon's best iPhone prices? Verizon offers a variety of. Apple iPhone 13 This monthly payment estimate reflects 0% APR when paying over 24 months and may require a down payment. Full price: $ Want to pay in. iPhone 13 prices start at $ and cost $ on average as of September iPhone 13 prices will continue to get cheaper over time. Product Comparison. Please select at least 2 items to compare. OK. Skip to Main Content. APPLE APPLE iPhone 13 GB iPhone The cost depends on the retail. Apple iPhone 13 Pro Max, GB, Sierra Blue - Unlocked (Renewed) · Refurbished - Excellent. $$ · Return this item for free · Refurbished - Good. $ I've always been eager to try an iPhone, and I'm considering switching from my current phone. Since the iPhone is still a relatively expensive. iPhone 15 ProiPhone 15iPhone 14iPhone 13iPhone SEiPhone 12AirPodsAirTagCell Celebrate with tons of super-low prices. Shop now. Restored Apple iPhone. Retail price: $ One-time activation fee of $ Device unlocking policy. Or, choose. iPhone Your new superpower. · Hearing Aid. M3/T4 · OS. iOS · Network. 5G LTE/Wi-Fi · Display. inch Super Retina XDR OLED, HDR10, Dolby Vision display. Apple iPhone 13 (Certified Pre-Owned). Starts at $0/mo. price is not offering Looking for Verizon's best iPhone prices? Verizon offers a variety of. Apple iPhone 13 This monthly payment estimate reflects 0% APR when paying over 24 months and may require a down payment. Full price: $ Want to pay in. iPhone 13 prices start at $ and cost $ on average as of September iPhone 13 prices will continue to get cheaper over time. Product Comparison. Please select at least 2 items to compare. OK. Skip to Main Content. APPLE APPLE iPhone 13 GB iPhone The cost depends on the retail. Apple iPhone 13 Pro Max, GB, Sierra Blue - Unlocked (Renewed) · Refurbished - Excellent. $$ · Return this item for free · Refurbished - Good. $

The cost of the iPhone 13 is between R13, - R16, copy. Product details. Lowest price for Apple iPhone 13 Pro Max GB is $1, This is currently the cheapest offer among 7 stores. Apple iPhone 13 This monthly payment estimate reflects 0% APR when paying over 24 months and may require a down payment. Full price: $ Want to pay in. Browse the latest iPhone models, plans, accessories and deals. Get started today. Apple adds $30 for ”unlocked”, so $ OTD. If the final trade-in value exceeds the cost of the new device, the difference will be refunded to your Spectrum Mobile Account. Trade-in device must have a. Prices and offers are subject to change. © Best Buy. All rights reserved. BEST BUY, the BEST BUY logo, the tag design, and MY BEST BUY are trademarks. If you were to buy an iPhone outright – paying the full cost upfront – the average price of an iPhone is $ Over a 24 month contract period, on average you. The iPhone 14 Pro retails between $ and $ but costs only around $ to make. iPhone Cost. The iPhone 15 is Apple's latest phone and comes in various. iPhone 13 Pro Prices ; GB iPhone 13 Pro Gold, $, $0 ; GB iPhone 13 Pro Graphite, $, $0 ; GB iPhone 13 Pro Sierra Blue, $, $0 ; GB iPhone 13 Pro. iPhone 15 Pro & iPhone 15 Pro Max · iPhone 15 & iPhone 15 Plus · iPhone 14 & iPhone 14 Plus · iPhone 13 · iPhone SE. iPhone. Explore iPhone. Explore All iPhone · iPhone 15 Pro · iPhone 15 · iPhone 14 · iPhone 13 · iPhone SE · Compare iPhone · Switch from Android. Shop iPhone. iPhone 13 Pro Max. The biggest Pro camera system upgrade ever. Super Retina XDR display with ProMotion for a faster, more responsive feel. Lightning-fast A Prices may vary by location. Enter your ZIP code to see plans. We'll use your ZIP code to show you the right protection plans for your area. ZIP code. Lowest price for Apple iPhone 13 GB is $ This is currently the cheapest offer among 20 stores. Elevate your smartphone experience with the. Apple iPhone $ - $ -. Color: Black. Investing in a cheap unlocked iPhone 13 series from Plug is a decision that pays off in both value and satisfaction. Our affordable prices make the latest. Iphone 13(8) ; $ · out of 5 Stars. reviews ; $ $ Was $ · out of 5 Stars. reviews ; Gold · Graphite · Gray · Pacific. The increased total cost is due to the higher estimated costs for the A15 processor, NAND memory, the display subsystem price, and an increase in the main.

Hiring A Lawyer Cost

Hourly fee: Most lawyers charge by the hour. The hourly rate can vary from lawyer to lawyer. To know how much your total bill might be, ask the lawyer to. The lawyer would then take % of that remaining $9,, leaving you with $6, Should You Pay It? In deciding whether to hire a lawyer on a contingency fee. Every attorney sets their own rates, and they are going to charge either a flat rate or an hourly rate. The public defender is free. That is the. Crimes fall into the felony category once they are serious enough to carry more than a year of prison time. How much does a criminal defense lawyer cost for a. Attorney Fee: the compensation a lawyer receives for legal services performed, in or out of court; can be an hourly rate, a flat rate, or a contingency fee. Costs Involved in Hiring a Disability Lawyer · The attorney's fee is limited to 25 percent of any past-due benefits the Social Security Administration (SSA). To reiterate, these attorneys take a percentage of the total settlement paid out by the other party. This percentage can be anywhere from percent. Your final cost will depend on how long it takes to complete the work. There is no standard hourly rate; rather, attorneys rates vary according to the. Hourly fee, which will can vary among lawyers. Ask the lawyer to estimate the amount of time your case will take, so you understand what your total costs may be. Hourly fee: Most lawyers charge by the hour. The hourly rate can vary from lawyer to lawyer. To know how much your total bill might be, ask the lawyer to. The lawyer would then take % of that remaining $9,, leaving you with $6, Should You Pay It? In deciding whether to hire a lawyer on a contingency fee. Every attorney sets their own rates, and they are going to charge either a flat rate or an hourly rate. The public defender is free. That is the. Crimes fall into the felony category once they are serious enough to carry more than a year of prison time. How much does a criminal defense lawyer cost for a. Attorney Fee: the compensation a lawyer receives for legal services performed, in or out of court; can be an hourly rate, a flat rate, or a contingency fee. Costs Involved in Hiring a Disability Lawyer · The attorney's fee is limited to 25 percent of any past-due benefits the Social Security Administration (SSA). To reiterate, these attorneys take a percentage of the total settlement paid out by the other party. This percentage can be anywhere from percent. Your final cost will depend on how long it takes to complete the work. There is no standard hourly rate; rather, attorneys rates vary according to the. Hourly fee, which will can vary among lawyers. Ask the lawyer to estimate the amount of time your case will take, so you understand what your total costs may be.

Employment attorneys generally charge anywhere from $ to $ per hour, depending on their years of experience, level of expertise, and issue. The answer depends on the outcome of your case, but the fees never exceed the amount of the settlement or judgment we helped you obtain. We take a percentage of. An hourly rate case is when your lawyer charges you for each hour (or portion of an hour) that they work on your case. For example, if the lawyer's fee is $ Yes! Many firms, including Volpe Law LLC, take on small transactional jobs for clients, which involve far less variability and thus can be billed at a flat rate. Throughout the United States, typical attorney fees usually range from about $ an hour to $ an hour. These hourly rates will increase with experience and. In most personal injury cases, there is not a limit on what the attorney can charge. However, generally speaking, a one-third contingency fee is the customarily. The cost of a criminal defense lawyer in Texas varies based on the complexity of the case and severity of the charges. Our team of lawyers will be able to. In many cases, you can expect a debt negotiation attorney to charge anywhere from $ to $ per hour. Fees Based on the Amount of Debt You Have. An attorney. Give the original and the 2 copies to the court clerk. Pay a $60 fee (unless you have a fee waiver). There may be other fees. For example, if you'. Many attorneys charge an hourly rate ranging from $ to $ per hour. The total cost will depend on how many hours the lawyer spends on your case, including. For some cases, the retainer fee might be a few hundred dollars, while it could be several thousand dollars for more complex matters. Discuss the retainer fee. That hourly rate will depend on the location and experience of the attorney but can range from $ to $ per hour. The number of hours will vary depending on. Payment Arrangements and Fees · Most states limit the kind of cases that are allowed to have contingency fee arrangements. · There is no standard amount or. As a general rule, you can expect to pay an attorney $ to $ per hour, though higher fees are common, and lower fees are sometimes possible. Every attorney has an hourly fee: a set amount the attorney charges for each hour of work under hourly fee arrangements. These hourly rates vary a great deal. Average Costs for Common Legal Services · Estate Planning (Simple Will): $ – $2, · Real Estate Closing (Flat Fee): $2, – $5, · Family Law (Divorce. The Social Security Administration (SSA) must approve all fee agreements for applicants using a lawyer to prepare their claim. Right now, lawyers can charge 25%. However, if you have a complex case that requires multiple court appearances and extensive research, you may need to pay several thousand dollars for legal. A lawyer's overhead normally is 35 percent to 50 percent of the legal fees charged. A lawyer's services normally involve research, investigation and case. The cost will depend on the law firm or lawyer you hire and the fee structure they adhere to. Typically, you can expect to pay anywhere from $$ per hour.

How To Calculate Interest On A Mortgage Loan

Free loan calculator to find the repayment plan, interest cost, and Use this calculator for basic calculations of common loan types such as mortgages. Hence, the rate is divided by 12 before calculating the payment. Consider a 3% rate on a $, loan. In decimals, 3% is, and when divided by 12 it is. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Step 1 - Take the current outstanding balance owed on your mortgage. · Step 2 - Multiply that number by your current interest rate as a decimal. · Step 3 - Divide. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. The interest rate is the amount of money your lender charges you for using their money. It's shown as a percentage of your principal loan amount. Understand. To calculate mortgage interest, start by multiplying your monthly payment by the total number of payments you'll make. Then, subtract the principal amount from. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Free loan calculator to find the repayment plan, interest cost, and Use this calculator for basic calculations of common loan types such as mortgages. Hence, the rate is divided by 12 before calculating the payment. Consider a 3% rate on a $, loan. In decimals, 3% is, and when divided by 12 it is. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Step 1 - Take the current outstanding balance owed on your mortgage. · Step 2 - Multiply that number by your current interest rate as a decimal. · Step 3 - Divide. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. The interest rate is the amount of money your lender charges you for using their money. It's shown as a percentage of your principal loan amount. Understand. To calculate mortgage interest, start by multiplying your monthly payment by the total number of payments you'll make. Then, subtract the principal amount from. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more.

Monthly payment formula · = -PMT( / / 12, 30 * 12, ) · = (( / / 12) * ) / (1 - ((1 + ( / / 12)) ^ ( * 12))) · = The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent of. payment, including principal, interest, taxes, and insurance. Read to begin the loan process? Call us today. We look forward to working with you! Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Loan term (years). It's really easy. Simple Interest = P × R × T, where P = Principal, R = Rate of Interest, and T = Time period. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. Land Loan Calculator. Your tool to determine land mortgage rates, interest, and More. What is a loan rate calculator? Capital Farm Credit provides a land. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. calculator to calculate estimated monthly payments and rate options for a variety of loan loan with a fixed interest rate for the entire term of the loan. The. How to calculate home loan interest repayments · Convert the interest rate to a decimal by dividing the percentage by · To obtain the annual interest charge. Mortgage interest is calculated as a percentage of the remaining principal. With most mortgages, you pay back a portion of the amount you borrowed (the. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. What Is a Fixed-Rate Loan? How Do I Calculate It? · Number of periodic payments (n) = payments per year times number of years · Periodic Interest Rate (i). Mortgage Calculator. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for. For example, let's say that John wants to purchase a house that costs $, and has saved up a $25, down payment. His loan amount (A) is $,, the. Compare how much you'll pay in principal and interest and see a combined mortgage loan Use this amortization calculator to estimate the principal and interest. Borrowers can calculate per diem interest using a simple formula. Learn more about what per diem interest is and how it can be calculated on a mortgage loan. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay. On the simple interest version, the annual rate of 6% is divided by , converting it to a daily rate of%. The daily rate is multiplied by the loan. Calculate mortgage repayments over the life of a loan The bank you are working with has offered you a fixed interest rate of % on a year, $, loan.

Can I Wipe My Credit File Clean

:max_bytes(150000):strip_icc()/remove-negative-credit-report-960734_final-607a7573d66d40b2b63ed410aa95e313.png)

Is there information on your credit report that's correct — just not so good? No one promising to repair your credit can legally remove information if it's. Late payments can be removed from credit reports only if they were reported in error. Learn more. The good news is, Wipe Credit Clean can remove your bad credit, regardless of whether the account is outstanding or paid. The first thing you need to do is gather all the information about the charge-off debt. That includes how much is owed, how old the debt is, and who currently. Contact one of the three credit bureaus (Experian, Equifax, or TransUnion) to place a fraud alert. (That bureau will contact the other two.) Contact each of the. "We can remove bankruptcies, judgments, liens, and bad loans from your credit file, FOREVER!" "Create a new credit identity - Legally!" Do yourself a favor and. The most efficient method is to tell your creditors to stop contacting you, then reach out one by one to attempt to negotiate a pay for delete. So, if you check your credit report and discover a collection account that shouldn't be there, you can send a dispute to Equifax, TransUnion, or Experian and. No, technically, you can't wipe your credit history. However, you can change your credit behavior to make improvements that will build better credit going. Is there information on your credit report that's correct — just not so good? No one promising to repair your credit can legally remove information if it's. Late payments can be removed from credit reports only if they were reported in error. Learn more. The good news is, Wipe Credit Clean can remove your bad credit, regardless of whether the account is outstanding or paid. The first thing you need to do is gather all the information about the charge-off debt. That includes how much is owed, how old the debt is, and who currently. Contact one of the three credit bureaus (Experian, Equifax, or TransUnion) to place a fraud alert. (That bureau will contact the other two.) Contact each of the. "We can remove bankruptcies, judgments, liens, and bad loans from your credit file, FOREVER!" "Create a new credit identity - Legally!" Do yourself a favor and. The most efficient method is to tell your creditors to stop contacting you, then reach out one by one to attempt to negotiate a pay for delete. So, if you check your credit report and discover a collection account that shouldn't be there, you can send a dispute to Equifax, TransUnion, or Experian and. No, technically, you can't wipe your credit history. However, you can change your credit behavior to make improvements that will build better credit going.

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by. The short answer to this question is one you might not wish to hear: as long as certain entries on your credit record are legitimate ones that genuinely. These are often the fastest ways to boost your credit score: Clean up any inaccurate or old information on your credit report. There should be no negative. Can I wipe my credit file clean? You can't completely wipe your credit file if you have a negative credit score, even if impacted by accurate information. Request copies of your credit reports You can request a free copy of your credit report from each of the three big credit reporting bureaus—Experian. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported for While negative credit listings can remain on your file for many years, sometimes credit repair can wipe your record clean within as few as 30 days. Bad. Claim that they can remove all the negative entries in your credit file. If the negative information in your credit report is accurate and up to date, the. Steps to improve your credit report · Order a copy of your credit reports · Check for errors and report any you find · Pay bills on time, every time · Clear up any. "The only items you can force off of your credit report are those that are inaccurate and incomplete," says McClelland. "Anything else will be at the discretion. You don't need to pay a credit repair company to clean up errors in your credit report. They may charge you high fees for things you can do by yourself for. They won't see your credit score, but activities that lead to a poor score—such as recent bankruptcies or high debt—will be visible on your credit report and. Ever wondered how a $2 late payment can affect your credit? Banks can list these small amounts on your liabilities without notifying you! The person in this. Removing negative credit report information can improve your credit score. Here are some ways to remove negative information from your credit report. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. You can negotiate with debt collection agencies to remove negative information from your Emphasize that a clean credit report will help you achieve your goals. Unfortunately, once the fraudulent accounts have been removed from your credit report, the hard credit inquiries will still be there. To remove hard credit. Taking control of your credit requires understanding what negative items are on your credit report. You can then develop a plan to address those items, such as. The goal of credit repair is to ensure you report is accurate. That way, when creditors review it you have a clean bill of credit health. This will often.

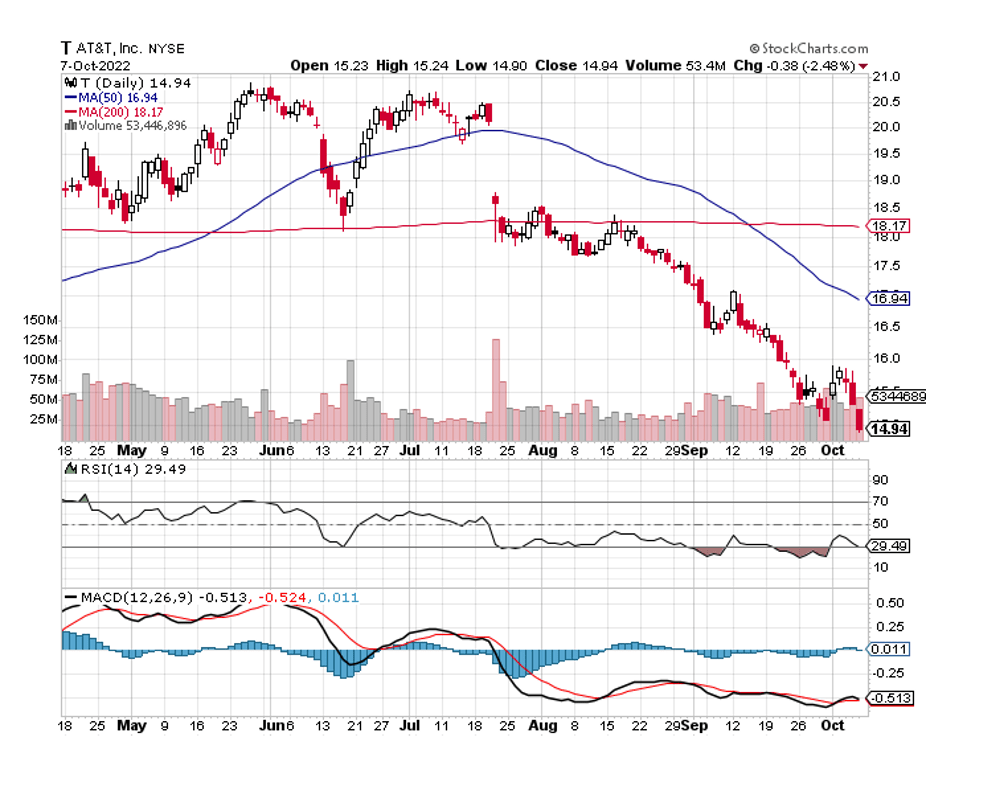

At&T Dividend Forecast

AT&T Inc. Historical Common Dividends Data ; , , , $ ; · , , $ The quarterly cash dividend was payable on August 1, to stockholders of record on July 10, Q. When is AT&T (NYSE:T) reporting earnings? A. AT&T's Q3. Ex-Dividend Date 07/10/ ; Dividend Yield % ; Annual Dividend $ ; P/E Ratio N/A. AT&T (T) announced on June 26, that shareholders of record as of July 10, would receive a dividend of $ per share on August 1, T currently. Find the latest AT&T Inc (T) stock forecast, month price target, predictions and analyst recommendations. Dividend growth rate (g) forecast ; 1, g · % ; 2, g · % ; 3, g · % ; 4, g · %. AT&T (T) last ex-dividend date was on Jul 10, AT&T distributed $ per share that represents a % dividend yield. T pays a dividend of $ per share. T's annual dividend yield is %. AT&T's dividend is higher than the US industry average of %, and it is higher than. Ex-Dividend Date 07/10/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. AT&T Inc. Historical Common Dividends Data ; , , , $ ; · , , $ The quarterly cash dividend was payable on August 1, to stockholders of record on July 10, Q. When is AT&T (NYSE:T) reporting earnings? A. AT&T's Q3. Ex-Dividend Date 07/10/ ; Dividend Yield % ; Annual Dividend $ ; P/E Ratio N/A. AT&T (T) announced on June 26, that shareholders of record as of July 10, would receive a dividend of $ per share on August 1, T currently. Find the latest AT&T Inc (T) stock forecast, month price target, predictions and analyst recommendations. Dividend growth rate (g) forecast ; 1, g · % ; 2, g · % ; 3, g · % ; 4, g · %. AT&T (T) last ex-dividend date was on Jul 10, AT&T distributed $ per share that represents a % dividend yield. T pays a dividend of $ per share. T's annual dividend yield is %. AT&T's dividend is higher than the US industry average of %, and it is higher than. Ex-Dividend Date 07/10/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A.

AT&T Inc. Quote. About. News. Financials. Forecasts. Competitors. AT&T Inc. T Dividend yield. %. Ex-dividend date. Jul 10, Dividend pay date. Aug 1. Dividend Yield (Trailing): %. Dividend Yield (Forward): %. Total Yield: %. Company Profile. The wireless business contributes nearly 70% of AT&T's. Based on short-term price targets offered by 22 analysts, the average price target for AT&T comes to $ The forecasts range from a low of $ to a high. Passive investors with a conservative strategy should hold this asset. It has a low beta coefficient and a high dividend yield. Month. 1 year. AT&T Inc.'s (T) dividend yield is %, which means that for every $ invested in the company's stock, investors would receive $ in dividends per year. AT&T Stock Analysis: Historical quarterly revenues per share for AT&T and historical quarterly revenue growth: Analysts estimate an earnings decrease this. Market CapB · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Get AT&T Inc. (T) consensus dividend estimates for fiscal year: consensus dividend payment, forward yield, high, low, number of analysts and chart. T pays dividends quarterly. Last paid amount was $ at May 01, As of today, dividend yield (TTM) is %. The last AT&T (T) dividend payout was $ per T share on July 10, , resulting in a % dividend yield. AT&T (T) distributes dividends on Quarterly. AT&T (T) 5-Year Dividend Growth Rate: % (As of Jun. ). View and export this data going back to Start your Free Trial. What is AT&T 5-Year. AT&T Dividend Yield: % for Sept. 9, · Dividend Yield Chart · Historical Dividend Yield Data · Dividend Yield Definition · Dividend Yield Range, Past 5. % forward dividend yield. Top 15%. beta (5Y monthly). Diversifier. 4% price target upside from sell-side analysts. Bottom 40%. Latest Updates · AT&T Inc. · AT&T Reports Second-Quarter Results · AT&T Declares Dividends on Common and Preferred Shares · AT&T to Webcast CEO John Stankey at. AT&T has an annual dividend of $ per share, with a yield of %. The dividend is paid every three months and the last ex-dividend date was Jul 10, Even when AT&T was increasing their dividend they would only increase by $/yr ($ every quarter) which is very low compared to any other. On average, Wall Street analysts predict that AT&T's share price could reach $ by Aug 15, The average AT&T stock price prediction forecasts a. According to the 18 analysts' twelve-month price targets for AT&T, the average price target is $ The highest price target for T is $, while the. T Earnings Forecast Next quarter's earnings estimate for T is $ with a range of $ to $ The previous quarter's EPS was $ T beat its EPS. For the upcoming trading day on Friday, 2nd we expect AT&T Inc to open at $, and during the day (based on 14 day Average True Range), to move between.

Whats A Payroll

Payroll is defined as a list containing all of the employees that an organization pays along with the salary or hourly rate at which each employee is paid. A software application that streamlines and automates crucial payroll processes such as calculating wages, salaries, and taxes, or generating payslips and. Processing payroll means compensating employees for their work. It involves calculating total wage earnings, withholding deductions, filing payroll taxes and. Outsourcing payroll services means that an outside company manages all or most of your payroll needs. This can be useful for businesses that are looking to save. Payroll in HR means the process of paying workers for their labor. HR professionals oversee this to ensure employees get their salaries on time. It involves. A payroll service is a third-party company or organization that assists with payroll processing. They simplify many things associated with timely and accurate. What is payroll? Payroll is the total of all compensation a business must pay to its employees for a set period of time or on a given date. A payroll system streamlines your organization's payment process, automating the calculation and distribution of wages at each pay period's end. It records. Payroll is the process by which employers calculate and distribute wages, salaries, and deductions to employees, ensuring compliance with tax and labor laws. Payroll is defined as a list containing all of the employees that an organization pays along with the salary or hourly rate at which each employee is paid. A software application that streamlines and automates crucial payroll processes such as calculating wages, salaries, and taxes, or generating payslips and. Processing payroll means compensating employees for their work. It involves calculating total wage earnings, withholding deductions, filing payroll taxes and. Outsourcing payroll services means that an outside company manages all or most of your payroll needs. This can be useful for businesses that are looking to save. Payroll in HR means the process of paying workers for their labor. HR professionals oversee this to ensure employees get their salaries on time. It involves. A payroll service is a third-party company or organization that assists with payroll processing. They simplify many things associated with timely and accurate. What is payroll? Payroll is the total of all compensation a business must pay to its employees for a set period of time or on a given date. A payroll system streamlines your organization's payment process, automating the calculation and distribution of wages at each pay period's end. It records. Payroll is the process by which employers calculate and distribute wages, salaries, and deductions to employees, ensuring compliance with tax and labor laws.

A payroll management system includes all the tasks associated with paying an organisation's personnel. It often entails keeping track of hours. Payroll refers to the compensation awarded to employees for their work or services for a company, including salaries, wages, benefits, and overtime. Importance of a payroll system. Running payroll involves compensating employees for their work, requiring employers to calculate and distribute wages accurately. Payroll is defined simply as the process of paying an employee during their payday. The process includes a detailed breakdown of not only the salary but the. A payroll ledger is an important document used by accountants, payroll managers, and other financial professionals to track wages received by each employee. Payroll refers to the compensation awarded to employees for their work or services for a company. Payroll is recorded as an expense from a company. Payroll is the keeping and organization of a business's financial records. These records include information on employee salaries, deductions, and bonuses. Payroll is the process that includes calculating each employee's earnings, withholding the correct income and social taxes, managing bonuses, commissions. Payroll is defined as a business function or process that all companies must undertake in order to pay their employees. What is payroll? Payroll is more than paying employees for work over a specified period; it refers broadly to the entire payroll management process. This. Payroll is the process of managing wages, salaries, and taxes for your business team, whether it's just you or a small group. A payroll is a list of employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each. A payroll register is tool that records wage payment information about each employee – gross pay, deductions, tax withholding, net pay and other payroll-related. Payroll software is an on-premises or cloud-based solution that manages, maintains, and automates payments to employees. Robust, integrated, and properly. Payroll is the process of organizing and delivering an employee's wages and ensuring that companies pay their employees their expected salary. What does the Payroll department do? Payroll involves recording exactly who is employed by the company and how they get paid. In the context of financial and. Payroll software integrates various business systems, such as accounting software, as well as employee attendance and time tracking, and human resource. A payroll system is a system that helps keep necessary records and calculate how much each employee is due. PAYROLL meaning: 1. a list of the people employed by a company showing how much each one earns: 2. the total amount. Learn more.