hangofranking.ru

Gainers & Losers

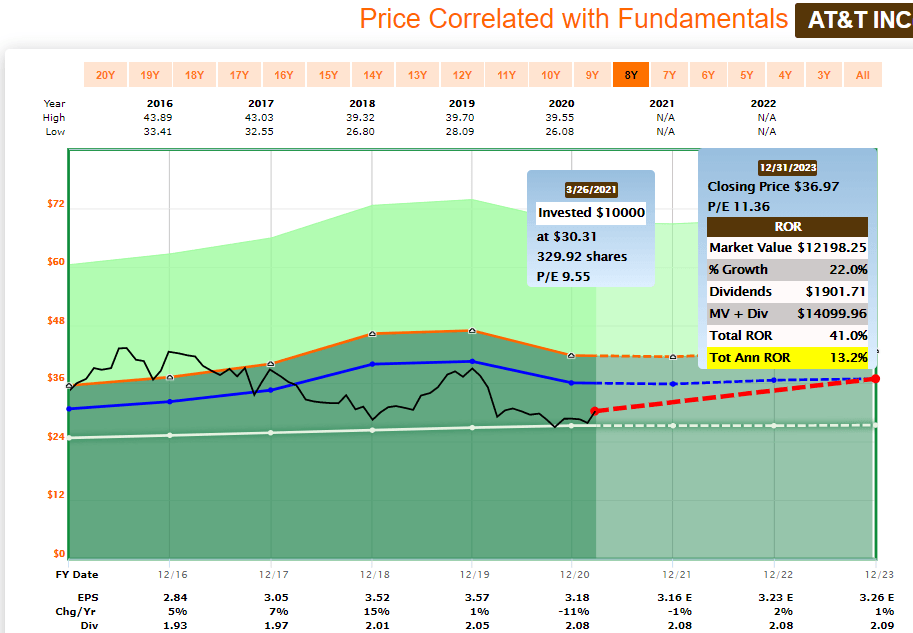

Should I Buy Att Stock

To buy fractional shares of AT&T stock, you'll need to sign up for Stash and To be eligible to receive a Stock Reward through stock party, you must. Is AT&T Inc a Good Stock to Buy? Determining whether AT&T Inc—or any stock—is a good buy requires comprehensive analysis. To evaluate its potential, users. AT&T has % upside potential, based on the analysts' average price target. AT&T has a consensus rating of Moderate Buy which is based on 11 buy ratings, 4. * hangofranking.ru does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Certain financial. If you acquired your AT&T Inc. shares on or after March 20, (the date of the last stock Shop · Subscribe to AT&T News; California Consumer Privacy. Pfizer (PFE) Vs AT&T (T): Stock comparison by AI. Which is a better buy? Make smart data-driven investment decisions and get unique insights. AT&T has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 10 buy ratings, 8 hold ratings. AT&T stock has been a solid performer over the years. Its best years are undoubtedly in the 90s when the stock rose to hit its all-time high of circa $60 in. Should I buy Stocks just for dividends? 1: If you want to pay all your monthly bills: Here I'll give my three top dividend stocks. I usually. To buy fractional shares of AT&T stock, you'll need to sign up for Stash and To be eligible to receive a Stock Reward through stock party, you must. Is AT&T Inc a Good Stock to Buy? Determining whether AT&T Inc—or any stock—is a good buy requires comprehensive analysis. To evaluate its potential, users. AT&T has % upside potential, based on the analysts' average price target. AT&T has a consensus rating of Moderate Buy which is based on 11 buy ratings, 4. * hangofranking.ru does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Certain financial. If you acquired your AT&T Inc. shares on or after March 20, (the date of the last stock Shop · Subscribe to AT&T News; California Consumer Privacy. Pfizer (PFE) Vs AT&T (T): Stock comparison by AI. Which is a better buy? Make smart data-driven investment decisions and get unique insights. AT&T has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 10 buy ratings, 8 hold ratings. AT&T stock has been a solid performer over the years. Its best years are undoubtedly in the 90s when the stock rose to hit its all-time high of circa $60 in. Should I buy Stocks just for dividends? 1: If you want to pay all your monthly bills: Here I'll give my three top dividend stocks. I usually.

Why Robinhood? Robinhood gives you the tools you need to put your money in motion. You can buy or sell AT&T and other ETFs, options, and stocks. August 12, hangofranking.ru Bank of America says buy this 'diamond in the rough must make the Manage Preference choices on each site/app on each. With its financial books on the mend, this could be a great time to invest in AT&T, especially if you get in before the WarnerMedia spinoff grants shareholders. With its financial books on the mend, this could be a great time to invest in AT&T, especially if you get in before the WarnerMedia spinoff grants shareholders. The AT&T stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Also, there is a general buy signal. Our technical rating for AT&T Inc. is buy today. Note that market conditions change all the time — according to our 1 week rating the buy trend is prevailing. To make the right choice, you should compare the fees, conditions, and how easily you understand the platform and the brokerage company's concept. In the. AT&T stock has received a consensus rating of buy. The average rating score is Baa2 and is based on 28 buy ratings, 24 hold ratings, and 0 sell ratings. What. In order to ensure the proper registration of your ownership of new AT&T common stock If you hold old AT&T certificated shares, you should have received an. Right now, AT&T's dividend yield is at one of the highest levels it has ever been, which could suggest that the company is undervalued. In addition, the company. Investing in stocks, such as ATT, is an excellent way to grow wealth. For long-term investors, stocks are a good investment even during periods of the market. This depends on individual goals, risk tolerance, and market conditions. Investors should evaluate AT&T's business fundamentals and market position before. Stock, Dividend & Shareholder Information What is AT&T's ticker symbol? AT&T's ticker symbol is "T" on the New York Stock Exchange. What exchange is AT&T. T Stock Overview · Trading at % below our estimate of its fair value · Earnings are forecast to grow % per year · Became profitable this year · Trading at. You could do better than buy AT&T, but you could also do worse. For someone without experience, high flying growth stocks like GoPro or. Buy NOK Stock? Aug. 28, at a.m. ET on hangofranking.ru 3 High-Yield These 3 High-Yield Dividend Stocks Could Turn It Into a Nearly $ Yearly Passive. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. T will report earnings. So AT&T Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a. The consensus among Wall Street research analysts is that investors should "moderate buy" T shares. Does AT&T's stock price have much upside? According to. AT&T stockholders must allocate their aggregate tax basis in their shares of AT&T common stock held immediately prior to the Distribution.

Mortgage Caculator

Use this simple mortgage calculator to get an estimate of what your monthly payments might look like or calculate how your down payment impacts what you pay. This calculator will compute your monthly mortgage payment amount based on the principal amount borrowed, the length of the loan, and the annual interest. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use our mortgage calculator built directly into it! Get accurate estimates for your monthly mortgage payments if you will be required to have private mortgage. Mortgage payment calculator Tell us your total mortgage amount and desired payment frequency and we'll calculate your monthly payments. Plus, find out how. Mortgage Calculator. Estimate your monthly payments, what you might need for a down payment and mortgage insurance at closing using the calculator below. You. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Use this mortgage payment calculator to get a better picture of what monthly payments to expect based on your house price, interest rate and down payment. You'. This free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. Use this simple mortgage calculator to get an estimate of what your monthly payments might look like or calculate how your down payment impacts what you pay. This calculator will compute your monthly mortgage payment amount based on the principal amount borrowed, the length of the loan, and the annual interest. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use our mortgage calculator built directly into it! Get accurate estimates for your monthly mortgage payments if you will be required to have private mortgage. Mortgage payment calculator Tell us your total mortgage amount and desired payment frequency and we'll calculate your monthly payments. Plus, find out how. Mortgage Calculator. Estimate your monthly payments, what you might need for a down payment and mortgage insurance at closing using the calculator below. You. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Use this mortgage payment calculator to get a better picture of what monthly payments to expect based on your house price, interest rate and down payment. You'. This free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule.

Calculate payments. Enter your home price, down payment, ZIP code and credit score into our calculator to see which mortgage option may fit your needs. We'll. Mortgage Calculator. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. To. Are you looking to buy a house? Whether a first time home buyer or a mortgage shopper, Interior Savings mortgage calculators can help you calculate how much. Mortgage Calculator. Put your numbers to work. Complete the fields below to estimate payment options, loan amount and an amortization period that works for you. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. Use this calculator to estimate payments when buying a home in St. John's, NF, including advanced options such as PITI, PMI, taxes and insurance. Total Payments $, Stacked Column Graph: Please use the calculator's report to see detailed calculation results in tabular form. Total Interest. What would you pay each month? Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. PURCHASE · REFINANCE. Our smart online calculator considers factors like PMI, HOA fees, and even taxes to give you the most accurate estimate for your home purchase or refinance. How It Works. This mortgage calculator serves as a powerful tool to estimate the total expense associated with your home purchase. Input the home price, down. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA. Get a breakdown of your mortgage, including taxes and interest rates. Enter your details for an estimated monthly mortgage payment from Union Home Mortgage. This is our basic monthly mortgage payment calculator with an amortization table included. It will quickly estimate the monthly payment based on the home price. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income. As a general rule, to qualify for a mortgage, your DTI ratio. Mortgage Calculator. Enter your information in the area below and click "Calculate" to see your estimated monthly payment. *Depending on the loan type and. This powerful tool is designed to provide you with personalized estimates of your monthly mortgage payments. By inputting key factors such as loan amount. Estimate your monthly mortgage payment with our free calculator. Create an estimated amortization schedule, see how much interest you could pay, and more. Use our mortgage calculator to see the impact of these variables along with an amortization schedule. Accurately calculating your mortgage can be a critical. Mortgage Calculator. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much.

Ishares Esg Advanced Total Usd Bond Market Etf

Get iShares ESG Advanced Total USD Bond Market ETF (EUSB:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. View iShares ESG Advanced Total USD Bond Market ETF (EUSB) stock price today, market news, streaming charts, forecasts and financial information from FX. Performance charts for iShares ESG Advanced Total USD Bond Market ETF (EUSB - Type ETF) including intraday, historical and comparison charts. Track iShares ESG Advanced Total USD Bond Market ETF (EUSB) price, historical values, financial information, price projection, and insights to empower your. Which technical analysis tools can be used to analyze iShares ESG Advanced Total USD Bond Market ETF? Check out various oscillators, moving averages and. About iShares ESG Advanced Total USD Bond Market ETF (EUSB). EUSB tracks a broad array of USD-denominated bonds, without restriction of credit quality or. Find the latest iShares ESG Advanced Total USD Bond Market ETF (EUSB) stock quote, history, news and other vital information to help you with your stock. The iShares ESG Advanced Total USD Bond Market ETF seeks to track the investment results of the Bloomberg MSCI US Universal Choice ESG Screened Index. Price. iShares ESG Advanced Total USD Bond Market ETF · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change+%. Get iShares ESG Advanced Total USD Bond Market ETF (EUSB:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. View iShares ESG Advanced Total USD Bond Market ETF (EUSB) stock price today, market news, streaming charts, forecasts and financial information from FX. Performance charts for iShares ESG Advanced Total USD Bond Market ETF (EUSB - Type ETF) including intraday, historical and comparison charts. Track iShares ESG Advanced Total USD Bond Market ETF (EUSB) price, historical values, financial information, price projection, and insights to empower your. Which technical analysis tools can be used to analyze iShares ESG Advanced Total USD Bond Market ETF? Check out various oscillators, moving averages and. About iShares ESG Advanced Total USD Bond Market ETF (EUSB). EUSB tracks a broad array of USD-denominated bonds, without restriction of credit quality or. Find the latest iShares ESG Advanced Total USD Bond Market ETF (EUSB) stock quote, history, news and other vital information to help you with your stock. The iShares ESG Advanced Total USD Bond Market ETF seeks to track the investment results of the Bloomberg MSCI US Universal Choice ESG Screened Index. Price. iShares ESG Advanced Total USD Bond Market ETF · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change+%.

Get the latest iShares ESG Advanced Total USD Bond Market ETF (EUSB) fund price, news, buy or sell recommendation, and investing advice from Wall Street. iShares ESG Advanced Total USD Bond Market ETF (EUSB) - stock quote, history, news and other vital information to help you with your stock trading and. Track iShares Trust - iShares ESG Advanced Total USD Bond Market ETF (EUSB) Stock Price, Quote, latest community messages, chart, news and other stock. iShares ESG Advanced Total USD Bond Market ETF. Price: undefined undefined Alternative ETFs in the ETF Database Total Bond Market Category. Type. General. ETF Summary. The index is a modified market value-weighted index designed to reflect the performance of U.S. dollar-denominated, taxable bonds with. View Ishares Trust Esg Advanced Total Usd Bd Mkt Etf (EUSB) stock price, news, historical charts, analyst ratings, financial information and quotes on. The iShares Trust - iShares ESG Advanced Total USD Bond Market ETF about ESG, USA, Passive, Bonds had a month return of +%. Find the latest iShares ESG Advanced Total USD Bond Market ETF (EUSB) stock quote, history, news and other vital information to help you with your stock. iShares ESG Advanced Total USD Bond Market ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y About EUSB. EUSB tracks a broad array of USD-denominated bonds, without. Fund Details. Legal Name. iShares ESG Advanced Total USD Bond Market ETF. Fund Family Name. BlackRock-advised Funds. Inception Date. Jun 23, Shares. The iShares ESG Advanced Total USD Bond Market ETF seeks to replicate as close as possible the price and yield performance of the Bloomberg MSCI US. Find the latest quotes for iShares ESG Advanced Total USD Bond Market ETF (EUSB) as well as ETF details, charts and news at hangofranking.ru Breadcrumb · EUSB · Dividend History. iShares ESG Advanced Total USD Bond Market ETF (EUSB) Dividend History. EUSB(NYSE Arca)+2 other venues. iShares ESG Advanced Total USD Bond Market ETF. This ETF provides exposure to US Mixed Ratings Aggregate Bonds Read more. Get detailed information about the iShares ESG Advanced Total USD Bond Market ETF. View the current EUSB stock price chart, historical data, premarket price. EUSB | A complete iShares ESG Advanced Total USD Bond Market ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for. The investment seeks to track the Bloomberg MSCI US Universal Choice ESG Screened Index. The index is a modified market value-weighted index designed to reflect. Latest iShares ESG Advanced Total USD Bond Market ETF (EUSB) stock price, holdings, dividend yield, charts and performance. Start investing in ETF! Explore Ishares ESG Advanced Total USD Bond Market ETF (Exchange-Traded Funds) quotes online or analyze past price movements of EUSB. See the company profile for Ishares ESG Advanced Total USD Bond Market ETF (EUSB-A) including business summary, industry/sector information.

Why Roth Ira

Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars. Unlike a. How does a Roth IRA work? · You choose to put some of your income into these plans now to save for retirement later. · The money is a voluntary amount you can. Benefits of a Roth IRA · You don't get an up-front tax break (like you do with traditional IRAs), but your contributions and earnings grow tax-free. A Roth IRA is a type of tax-advantaged retirement savings account. 2 You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. Your Roth IRA earns money (interest), and those earnings are automatically added to your contributions. When you retire and start taking money out of your Roth. Roth IRAs allow you to save and invest money for your retirement. The key difference: your contributions to a Roth IRA are made with after-tax dollars. A big reason is that the Roth IRA provides a great source of money without triggering tax consequences. k, traditional IRA and even assets in. The Roth IRA offers big tax advantages. Like its cousin the traditional IRA, a Roth IRA offers individuals an opportunity to save for retirement on a tax-. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars. Unlike a. How does a Roth IRA work? · You choose to put some of your income into these plans now to save for retirement later. · The money is a voluntary amount you can. Benefits of a Roth IRA · You don't get an up-front tax break (like you do with traditional IRAs), but your contributions and earnings grow tax-free. A Roth IRA is a type of tax-advantaged retirement savings account. 2 You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. Your Roth IRA earns money (interest), and those earnings are automatically added to your contributions. When you retire and start taking money out of your Roth. Roth IRAs allow you to save and invest money for your retirement. The key difference: your contributions to a Roth IRA are made with after-tax dollars. A big reason is that the Roth IRA provides a great source of money without triggering tax consequences. k, traditional IRA and even assets in. The Roth IRA offers big tax advantages. Like its cousin the traditional IRA, a Roth IRA offers individuals an opportunity to save for retirement on a tax-. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity.

Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket. If you have a traditional IRA account, it's possible to convert it to a Roth IRA account to take advantage of tax-free growth. Roth IRAs are a great way for people to save for retirement, and they're becoming even more popular, especially with younger investors. Roth IRA Features & Benefits · Any interest and investment earnings accumulate on a tax-deferred basis and may be distributed tax-free if "qualified." · No. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. MissionSquare offers traditional, Roth, and SEP IRAs. Each has different advantages based on your current income, and short- and long-term needs, goals, and. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a With a ROTH, you pay tax on your income, put it in the ROTH, and then never pay tax on that money again. Whenever you withdraw in retirement. A Roth IRA allows for tax-deferred investment: You pay taxes on your contributions at the time you put money in and any growth is tax-free. A Roth IRA is a type of tax-advantaged retirement savings account. 2 You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. A Roth IRA can be a great way to save for retirement since the accounts have no required minimum distributions and you withdraw the money tax-free. All contributions to a Roth IRA are made on an after-tax basis, but the Roth IRA provides the opportunity for tax-free investment earnings and tax-free. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the. A Roth IRA is designed to help you save for retirement with after-tax contributions that offer the potential for tax-free income in retirement. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. Roth IRAs let you invest for retirement today and withdraw tax-free later. Open a Roth to experience Betterment's retirement advice and technology. Your Roth IRA earns money (interest and/or dividends), and that money is constantly added to your contributions. When you retire and start taking money out of. A Roth IRA offers tax-free withdrawals during retirement, but contributions are made with after-tax dollars. A Roth IRA is an individual retirement account that allows people below a certain income ceiling to contribute a fixed amount of money each year and invest it.

How To Invest In Managed Funds

Investors buy mutual fund shares from the fund itself or through a broker for the fund, rather than from other investors. The price that investors pay for the. Managed fund. An investment fund that pools monies from a range of investors to buy assets such as cash, shares, bonds and listed property trusts. mFund Profile. Active funds try to beat market returns with investments hand-picked by professional money managers. Compare indexing & active management. Each strategy has a. Minimum account balance for BNY Mellon Managed Asset Program Mutual Fund Series is $25, Equity separate account portfolios within the Customized Investment. If the overall market grows, your investment is likely to follow the market. It's a good way to invest for retirement without putting in a lot of additional. Managed Portfolio Strategies at J.P. Morgan. We design portfolios and strategies that are tailored precisely to help meet your objectives. By harnessing our. Mutual funds are pooled investments managed by professional money managers. They trade on exchanges and provide investors with access to a wide mix of. This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Fidelity's actively managed funds benefit from the supervision of one or several experts who scour the market looking for opportunities to beat the market. Investors buy mutual fund shares from the fund itself or through a broker for the fund, rather than from other investors. The price that investors pay for the. Managed fund. An investment fund that pools monies from a range of investors to buy assets such as cash, shares, bonds and listed property trusts. mFund Profile. Active funds try to beat market returns with investments hand-picked by professional money managers. Compare indexing & active management. Each strategy has a. Minimum account balance for BNY Mellon Managed Asset Program Mutual Fund Series is $25, Equity separate account portfolios within the Customized Investment. If the overall market grows, your investment is likely to follow the market. It's a good way to invest for retirement without putting in a lot of additional. Managed Portfolio Strategies at J.P. Morgan. We design portfolios and strategies that are tailored precisely to help meet your objectives. By harnessing our. Mutual funds are pooled investments managed by professional money managers. They trade on exchanges and provide investors with access to a wide mix of. This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Fidelity's actively managed funds benefit from the supervision of one or several experts who scour the market looking for opportunities to beat the market.

Where can you invest in managed funds? It is very easy to buy and sell funds using a self-select ISA. Other ISAs will also distribute money to funds in an. Investing in managed funds When you invest in a managed fund, you hold units in the fund. For example, an investment of $5, at a unit price of $1 gets you. Rather than following preset rules to build a portfolio of stocks or bonds, managers of actively managed mutual funds make buy and sell decisions, selecting. Investment fund An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part. Mutual fund trades are executed once a day, at a single price. ETFs are exchange-traded and can be bought and sold intraday at different prices. See More. Opening a Generate Managed Funds account is relatively easy. You can invest on your own, open a joint account with someone else, or for larger investments you. Home to our fund investment strategies, solutions and investment insights for all investor types, both individuals and financial professionals. By using a managed fund, investors' money is pooled together and is used by the investment manager to buy investments and manage them on behalf of all investors. iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF; Vanguard Russell ETF; Vanguard Total Stock. Information and resources from the Washington Department of Financial Institutions. Schwab Funds · All funds have no load and no transaction fees. · Schwab Funds® have asset-weighted operating expense ratios that are below industry average. Mutual funds are equity investments, as individual stocks are. When you buy shares of a fund, you become a part owner of the fund, and you share in its profits. A type of investment fund that uses a company structure. A CCIV is set up using one or more sub funds and an investor can buy shares in one or more of those sub. Mutual funds. Pool your money with the money of other investors to purchase tens or hundreds of different stocks, bonds or other investments. As the fund's. Investing in Opportunity. Institutional investors – like pensions, non-profits, and college endowments – use alternative investments as a tool to manage risk. Some funds (managed funds or ETFs) are set up to automatically follow a benchmark index like the S&P/NZ 50 or the S&P These are called 'index' funds. The. Funds fall into two main categories – unit trusts and open-ended investment companies (OEICs). They share many characteristics, for example both are normally. So, what is a managed fund? Put simply, it's a professional managed investment portfolio where your money is pooled together with other investors to buy and. BlackRock offers a wide range of managed funds and iShares ETFs to help build a diversified investment portfolio. Explore our funds now. Investing in mutual funds with J.P. Morgan. Access thousands of different securities through mutual funds from a variety of public companies. Use Self-Directed.