hangofranking.ru

Community

How To Post A Review On Google

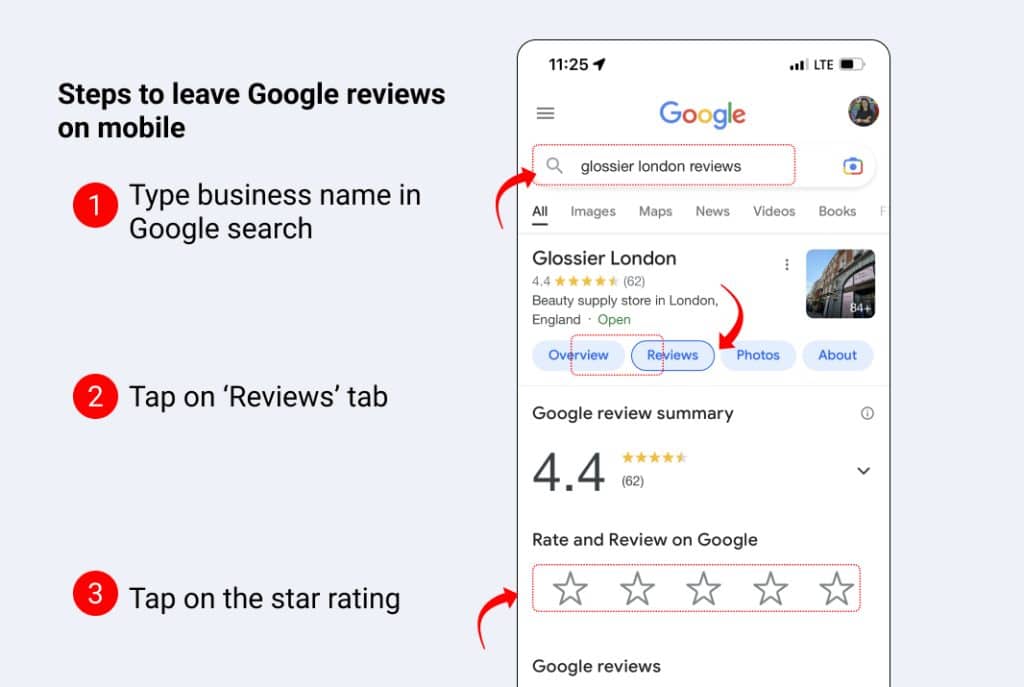

Step 1: Google search the business name. Step 2: Rate the business and write a review. Step 3: Connect a preferred email address. Step 4: Share any relevant. Google reviews serve as free marketing Reviews demonstrate the service and products that potential customers can expect from your business. Look at the. 1. Log in to your Google account. · 2. Search for the business you'd like to review. · 3. Click "write a review" below the business's name. Upvote. For a review post, you are going to navigate to the Google Reviews for your business and pick one you want to highlight. Google Reviews Screen. Once you have. If you already have a Google My Business or Google Business Profile, it'll be simple to figure out how to share a review link on Google. Simply log into your. Your first step in writing a review on Google is to set up a Google account. This will enable you to access all the features of Google services. To review on a computer, visit Google Maps, search for the location, select the "Reviews" tab, then click 'Write a Review. '. Is it possible to post a review through the google-maps-api? The only answer I've found was that in it wasn't possible but planned to be implemented. Click the “Share review form” button. Your Google review link will appear. Simply click the link to copy; there should also be options for sharing the link on. Step 1: Google search the business name. Step 2: Rate the business and write a review. Step 3: Connect a preferred email address. Step 4: Share any relevant. Google reviews serve as free marketing Reviews demonstrate the service and products that potential customers can expect from your business. Look at the. 1. Log in to your Google account. · 2. Search for the business you'd like to review. · 3. Click "write a review" below the business's name. Upvote. For a review post, you are going to navigate to the Google Reviews for your business and pick one you want to highlight. Google Reviews Screen. Once you have. If you already have a Google My Business or Google Business Profile, it'll be simple to figure out how to share a review link on Google. Simply log into your. Your first step in writing a review on Google is to set up a Google account. This will enable you to access all the features of Google services. To review on a computer, visit Google Maps, search for the location, select the "Reviews" tab, then click 'Write a Review. '. Is it possible to post a review through the google-maps-api? The only answer I've found was that in it wasn't possible but planned to be implemented. Click the “Share review form” button. Your Google review link will appear. Simply click the link to copy; there should also be options for sharing the link on.

A Google review request should be tailored to both the customer, and to your brand. In the first instance, include the customer's name and specific details. When writing reviews, focus on the quality and originality of your reviews, not the length, following as many of the above best practices as you are able. Click on the “Write a Review” Button: Within the “Reviews” section, you'll find a button labeled “Write a Review.” Click on it to proceed. Rate. As a general guide, though, what you'll need to do is find your GMB profile, select the review you wish to flag, and then select the option that says 'flag as. 1. Log in to your Google account. · 2. Search for the business you'd like to review. · 3. Click "write a review" below the business's name. Upvote. Google reviews serve as free marketing Reviews demonstrate the service and products that potential customers can expect from your business. Look at the. It can take anywhere from a few days to a couple of weeks for your review to appear on Google. This is because Google needs to verify that your review is real. How To Create A Google Review Link · Go to your Google Business Page · Click on “Write a review” · Copy the URL from the address bar. How to Share Google Review Link with your new Google Profile on Search · 1 - Go to Google Search Engine - hangofranking.ru · 2 - Search Your Business Name Title · 3. Once you're done, tap "Post" to publish your review. If you need to edit or delete a review, simply open the Google Maps app and tap on ". Having a second profile at Google, one that uses an alias rather than your own name, is the only option you have. You should never be worried about getting a bad review. By the time you've finished your job you should know exactly how the customer feels about your work. Adding photos to Google reviews · Search for the business you want to review on Google or Google Maps · Once you find the business, select “Write a Review.”. The time it takes for Google to publish a review can vary, with some taking a few hours and others taking a few days. Several factors can affect this timeline. 91 review examples and templates to publish. + responses to Google Reviews with this response generator. Copy the URLs in Google Docs, ping the URLs to get it indexed faster. One word of caution with negative reviews. This could have legal. TrueReview makes it easy to send text message and email review requests that get results, even providing a QR code customers can scan to quickly access the. If you already have a Google My Business or Google Business Profile, it'll be simple to figure out how to share a review link on Google. Simply log into your. How to Ask for a Google Review · Always Remember to Ask · Find the Right Time · Make it Easy for Customers to Review Your Business · Use Both Email and Texts to Ask. Open the Google Maps app and click on your profile icon. · Select “Your Business Profiles”. · In the Overview section, scroll down to “Get more reviews” and.

Mortgage Calculator With Savings

Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay. Home Financing. Calculate a Mortgage Payment · Rent or Buy? Proceeds from Sale of a Home · Home Affordability · Compare Two Mortgage Loans · Adjustable Rate. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Use the refinance calculator to find out how much money you could save every month by refinancing. Calculate your potential savings. Are you looking to buy a house? Whether a first time home buyer or a mortgage shopper, Interior Savings mortgage calculators can help you calculate how much. Amortization isn't just used for mortgages — personal loans and auto loans are other common amortizing loans. Just like with a mortgage, these loans have equal. Find out how much interest you can save by paying an additional amount with your mortgage payment. The additional amount will reduce the principal on your. Use our mortgage calculator and find out if you can afford your dream of homeownership. It's accessible and easy to use. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay. Home Financing. Calculate a Mortgage Payment · Rent or Buy? Proceeds from Sale of a Home · Home Affordability · Compare Two Mortgage Loans · Adjustable Rate. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Use the refinance calculator to find out how much money you could save every month by refinancing. Calculate your potential savings. Are you looking to buy a house? Whether a first time home buyer or a mortgage shopper, Interior Savings mortgage calculators can help you calculate how much. Amortization isn't just used for mortgages — personal loans and auto loans are other common amortizing loans. Just like with a mortgage, these loans have equal. Find out how much interest you can save by paying an additional amount with your mortgage payment. The additional amount will reduce the principal on your. Use our mortgage calculator and find out if you can afford your dream of homeownership. It's accessible and easy to use. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Our interactive calculators are offered to help you make decisions. Let's get started. Mortgage Rates. Home Equity Rates. The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details. Leader Bank offers mortgage calculators to help you calculate your mortgage goals Mortgage Tax Savings Calculator · Purchase Price and Down Payment Mortgage. Home price, the first input for our calculator, is based on your income, monthly debt payment, credit score and down payment savings. One of the rules you may. Find out how much you can save over the life of your mortgage by increasing your monthly payments with our free Payment Savings Calculator. Calculate your regular mortgage payments, based on the amount, rate, payment frequency and mortgage term. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay and. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. saving you hundreds over the life of your loan. Get an idea of what you may be able to save with this free extra payments calculator. Consider a refinance. Home loans /. Mortgage loans /. Mortgage calculators /. Amortization calculator Use this amortization calculator to get an estimate of cost savings and more. Whether you're shopping for a mortgage or a savings plan, we have a variety of helpful calculators to take the guesswork out of your decision. This mortgage refinance interest savings calculator estimates your closing costs, breakeven timeline & how much you could save by refinancing your mortgage. More about that below, but if your closing costs will be $4,, for instance, and your monthly savings are $, then you'll break even in 24 months or two. There are many factors that comprise mortgage payments besides purchase price and interest rate. These calculators is intended for illustrative purposes only and is not intended to purport actual user-defined parameters. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. Mortgage Calculators Use our mortgage calculators to determine a mortgage plan that works well for you. Determine what your potential mortgage payment may. Leader Bank offers mortgage calculators to help you calculate your mortgage goals Mortgage Tax Savings Calculator · Purchase Price and Down Payment Mortgage. When planning to buy a home mortgage tools are essential. Planning couldn't be easier when using a quick mortgage calculator showing monthly payments. Here we're calculating the savings benefit assuming you apply an additional amount of principal to your current monthly mortgage payment. Standard Payment.

Mold Vent Cleaning

Knowing the signs that mold may be present in your ducts gives you the opportunity to hire a professional air duct cleaner to inspect and clean the ducts, which. When the water droplets settle on the AC parts, they make the system conducive for mold growth. If you also fail to clean your condensate drain line, it will. EnviroCon is an EPA-approved antimicrobial that tackles mold, mildew, and bacteria. It also doubles as a deodorizer, leaving your inside air smelling fresh and. Use these proven and successful mold removal and mold remediation procedures and techniques for mold growth in basements, crawl spaces, attics, and on and. Could the problem be black mold in the HVAC system? As an air duct cleaning company, Dynasty Ducts. You can trust our team at Mold Remediation of Orlando to provide high-quality cleaning to your heating and cooling system. Call us at for a free on. Generally, HVAC mold cleaning costs range from $ - $, due to the equipment and time needed to complete a full-scale cleaning. Companies may charge a flat. The best way to get rid of mold is to replace the duct, the plenums, and clean the coil properly if you have ac and Heat. You can also add a quality uv light. We find and eliminate any sources of excess moisture that cause mold. · Removing debris from air registers · Cleaning the furnace, air handler, and plenum. Knowing the signs that mold may be present in your ducts gives you the opportunity to hire a professional air duct cleaner to inspect and clean the ducts, which. When the water droplets settle on the AC parts, they make the system conducive for mold growth. If you also fail to clean your condensate drain line, it will. EnviroCon is an EPA-approved antimicrobial that tackles mold, mildew, and bacteria. It also doubles as a deodorizer, leaving your inside air smelling fresh and. Use these proven and successful mold removal and mold remediation procedures and techniques for mold growth in basements, crawl spaces, attics, and on and. Could the problem be black mold in the HVAC system? As an air duct cleaning company, Dynasty Ducts. You can trust our team at Mold Remediation of Orlando to provide high-quality cleaning to your heating and cooling system. Call us at for a free on. Generally, HVAC mold cleaning costs range from $ - $, due to the equipment and time needed to complete a full-scale cleaning. Companies may charge a flat. The best way to get rid of mold is to replace the duct, the plenums, and clean the coil properly if you have ac and Heat. You can also add a quality uv light. We find and eliminate any sources of excess moisture that cause mold. · Removing debris from air registers · Cleaning the furnace, air handler, and plenum.

BIOSPRAY-TOWER ready-to-use disinfectant and mold cleaner will kill and remove mold, mildew, and odor-causing bacteria. Clean the HVAC evaporator coils using a. By cleaning your ducts, your system will remain cleaner, which means it will operate more efficiently, last longer, and require less energy. Dryer Vent Cleaning. Air Duct Mold Removal and Remediation, Commercial Coil Cleaning, and Air Vent Cleaning in Houston, TX. Commercial Air Duct Sealing, and Duct Cleaning. Let the expert HVAC mold remediators of AirWiz Duct Cleaning eradicate the problem with our inspection, cleaning, and after-service treatment. Lots of bad duct cleaners will seal the inside of the duct. This sealer will break down over time. Like said if cleaned correctly it should be 98 to 99 percent. The basic cost to Clean Mold From Air Ducts is $ - $ per square foot in August , but can vary significantly with site conditions and options. Removing Mold from Air Conditioning Vents · Unscrew the vent from the wall or ceiling and bring it outside. · Rinse off the vent with a garden hose. · Apply a. Our team at Miami Mold Specialist has implemented personalized protocols for properties where HVAC systems, vents, and ducts are compromised. With our organic. Hiring a separate mold remediation company to tackle the issue typically ranges from $1, to $5,, depending on the extent of the spread and damage caused. Mould in air ducts is a problem no homeowner wants to face. Mould spores inside your air ducts can easily spread throughout your home when the HVAC system. Improve the air quality in your home or business by maintaining clean air ducts and dryer vents. Air duct cleaning eliminates contaminants like dust, mold. Better Air is your choice for Mold Removal Duct Cleaning services throughout CT & MA. BBB A+ accredited / Rated!. Call today! () Removing Mold from Air Conditioning Vents · Unscrew the vent from the wall or ceiling and bring it outside. · Rinse off the vent with a garden hose. · Apply a. Air Duct Mold Remediation in Elizabethtown, Lancaster, Harrisburg, York, Reading PA, and Mechanicsburg. Get Air Duct Cleaning, Air Duct Mold Removal. Clean ducts mean less dirt in your home and air because ductwork is often the source and pathway for dust and biological contaminants. There can be pounds of. AdvantaClean is the premier provider of duct cleaning. Our professional technicians perform thorough cleanings, eliminating contaminants like dust, mold, and. Mould: Mould growth can occur in the components of your heating and cooling and air duct system. If you notice signs of mould, such as a musty odor your system. If you have experienced problems of excessive moisture or flooding in your home, our Installers can look for signs of mould in your ductwork. A thorough air. Learn how to effectively clean mold out of your HVAC air ducts and breathe easier. Take action now to improve your indoor air quality. For over 30 years we have provided professional air duct cleaning services to New York City and the Tri-State areas. If you suspect mold inside your ducts or.

Best Funds To Invest In During A Recession

High-quality stocks: Companies with low debt, positive earnings, strong cash flow, and low volatility tend to outperform when recessions hit and investors turn. That could mean more opportunities for actively managed bond mutual funds and ETFs, and also continued potential opportunities for those seeking attractive. Best Investments to Recession-Proof Your Investment Portfolio · 1. Commodities · 2. Pharmaceuticals · 3. Technology Startups · 4. Grocery Stores · 5. Utility Stocks. These deep cuts can impair their productivity and ability to fund new investments. Leverage effectively limits companies' options, forcing their hand and. Unlike deposits at a credit union or bank, most investments in stocks are not insured and you can lose some or all of your investment if prices fall after you. Best-day investments (Market lows). Date of market low. Cumulative investment. Total value. 8/12/ $10, $11, 4/20/ 20, 23, 6/13/ Surviving a recession: the best funds to invest in during an economic turmoil · Hedge Funds. Hedge funds are a good choice if you desire higher risk with a. What happens to my investments during a recession? Investing isn't a game we best of you when it comes to your investments. Legal. 1https://www. The sharp declines in stock prices that occur during a crisis or recession may present good opportunities to invest. Some companies may be undervalued by the. High-quality stocks: Companies with low debt, positive earnings, strong cash flow, and low volatility tend to outperform when recessions hit and investors turn. That could mean more opportunities for actively managed bond mutual funds and ETFs, and also continued potential opportunities for those seeking attractive. Best Investments to Recession-Proof Your Investment Portfolio · 1. Commodities · 2. Pharmaceuticals · 3. Technology Startups · 4. Grocery Stores · 5. Utility Stocks. These deep cuts can impair their productivity and ability to fund new investments. Leverage effectively limits companies' options, forcing their hand and. Unlike deposits at a credit union or bank, most investments in stocks are not insured and you can lose some or all of your investment if prices fall after you. Best-day investments (Market lows). Date of market low. Cumulative investment. Total value. 8/12/ $10, $11, 4/20/ 20, 23, 6/13/ Surviving a recession: the best funds to invest in during an economic turmoil · Hedge Funds. Hedge funds are a good choice if you desire higher risk with a. What happens to my investments during a recession? Investing isn't a game we best of you when it comes to your investments. Legal. 1https://www. The sharp declines in stock prices that occur during a crisis or recession may present good opportunities to invest. Some companies may be undervalued by the.

Economic downturns do not last forever, and if history is a guide, a good way to avoid losses in a recession is to take a long-term approach and ignore the. Which Bonds Perform Best In A Recession? · 1. US Treasury Bond/ Federal Bonds · 2. Municipal Bonds and TIPS · 3. Taxable Corporate Bonds. From mutual funds and ETFs to stocks and bonds, find all You should consider whether you would be willing to continue investing during a long downturn. The housing sector led not only the financial crisis, but also the downturn in broader economic activity. Residential investment peaked in , as did. going into the recession: sell equities and corporate bonds, buy intermediate treasuries. In the middle of the recession, buy high yield bonds. Overall, most would agree that commodity based investments are the best asset to hold during a recession. These are ETFs, stocks, mutual funds or other. As noted above, student housing is another great investment to make during a recession, particularly student housing in primary markets near the nation's top. If you're already in the stock market, look to expand and add high dividend stocks like mutual funds and exchange-traded funds (EFTS) that invest in consumer. What Should You Invest in During a Recession? Real estate is arguably the best asset to invest in during a recession. But, it's important to understand that. Investing in essentials like utilities is a classic lower-risk investment. Even during a recession, there will always be a need for the service utilities offer. High-Yield Savings Account A high-yield savings account might not be the best long-term investment for your money, but it can be a great place to ride out. 1. Stocks and bonds have historically experienced gains before a recession begins · 2. Not all recessions are the same · 3. Investing during a recession isn't. A fund that invests in this manner is Vanguard LifeStrategy 60% Equity. It provides 60% exposure to global equities and 40% exposure to global bonds via several. From mutual funds and ETFs to stocks and bonds, find all You should consider whether you would be willing to continue investing during a long downturn. The best way to get through a recession is by having a diversified portfolio – one of the hallmarks of wise investing in any economic cycle. A diversified. REITs are a popular asset class to invest in during a recession. Because people still need a place to live and work regardless of the broader economy, REITs are. The best investment method is a steady one. On any given day, you may have positive or negative returns. But over long periods, the markets tend to go up. Also. If anything, a market downturn is a good time to buy stocks cheaply. For those who want to take advantage but have low risk, Kendall recommends a dollar-cost. Our thought leaders share timely insights and observations on matters relevant to investors, the investment industry, and the world's financial markets and. A list of the top companies in which the fund is invested and the percentage choices during inevitable periods of high market volatility. Will you.

Loans For People With No Income

Personal loans for low income individuals are available. However, you will want to make sure you are attempting to borrow within your means. Single Family Housing Direct Loans · Purchase or build with no money down in eligible rural areas · Low or Very-Low Income · Typically year term with payment. Low-income loans are designed for people who may be turned away from other lenders or turned down for traditional personal loans based on income. These loans. Take a loan with the help of a cosigner. It is good option for unemployed people with no income neither any assets. Basically, a cosigner is a third party who. Offers two types of low-interest loans via their Mini Loan Program. To qualify for these loans, you must have a current income and a bank account with direct. Loans for people with bad credit scores. Before applying for a loan, keep in income. Consider a co-signer. To help increase your chances of getting. Can You Get a Loan Without Proof of Income? · Cash · Cash-value life insurance · Equity in rental property or other capital investments · Lump-sum receipts. How Can I Get a Loan Without Proof of Income? · government benefits · retirement funds · investment returns · alimony · child support · money from a structured. If you don't have enough verifiable income on your own, having a cosigner may allow you to get personal loan approval. Recommended: What Is a Guarantor on a. Personal loans for low income individuals are available. However, you will want to make sure you are attempting to borrow within your means. Single Family Housing Direct Loans · Purchase or build with no money down in eligible rural areas · Low or Very-Low Income · Typically year term with payment. Low-income loans are designed for people who may be turned away from other lenders or turned down for traditional personal loans based on income. These loans. Take a loan with the help of a cosigner. It is good option for unemployed people with no income neither any assets. Basically, a cosigner is a third party who. Offers two types of low-interest loans via their Mini Loan Program. To qualify for these loans, you must have a current income and a bank account with direct. Loans for people with bad credit scores. Before applying for a loan, keep in income. Consider a co-signer. To help increase your chances of getting. Can You Get a Loan Without Proof of Income? · Cash · Cash-value life insurance · Equity in rental property or other capital investments · Lump-sum receipts. How Can I Get a Loan Without Proof of Income? · government benefits · retirement funds · investment returns · alimony · child support · money from a structured. If you don't have enough verifiable income on your own, having a cosigner may allow you to get personal loan approval. Recommended: What Is a Guarantor on a.

Low debt-to-income ratio; No delinquent debt and a proven history of on-time people by having low credit score requirements or offering joint loans. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. Government loans for unemployed people are interest-free loans from the government's social fund, which can be used to pay for clothing, rent and household. There are a variety of lenders and financial institutions that provide small-dollar loan options without requiring a look at your credit score. It's important. Any ideas where I can get a personal loan with no (not much) income proof? Would prefer not a car loan as I can afford full insurance a bank. A Washington stated income loan, also known as a no doc no income verification loan, is one of the most popular lending programs offered to real estate. Q: What would you recommend for someone who needs a loan but has no credit? A: In that case, they will need to provide sources of their income and the amount. 1. Vivaloan hangofranking.ru stands out as a leading provider of personal loan without cibil and income proof, offering a reliable and flexible. hangofranking.ru can help you start your search for government loans. Browse by category to see what loans you may be eligible for today. You can get a personal loan without a job—but you'll need to have someone in your life who is willing to help you out. For those without a source of income. Getting a personal loan with no income verification is still a possibility, however. Lenders will simply have to look at other issues concerning the borrower. Alternative Income Sources. Unemployment benefits; Retirement benefits/pension · 1. Apply with a co-signer · 2. Get a joint personal loan · 3. Apply for a home. Bad credit high income loans are easier to qualify for compared to bad credit low income loans. While it's still a greater risk to loan money to a bad credit. Other ways to qualify for a personal loan while unemployed · Social Security · Unemployment benefits · Alimony or child support · Spouse's income · Pension or. those walls or replace that sink. With a personal loan, you don't have income, the potential for rollovers and refinancings, and legal parameters. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. You receive funds in one lump sum and. No credit loans are personal loans that do not require you to have a credit score to get approved. Loans for people with no credit also tend to have high. Can I get a loan with no employment? Yes, you may be able to find a lender if you have a source of income that will enable you to make the loan repayments. But. Based on our research, Upgrade is the best choice for low-income loans. Its financial products usually come with manageable rates and fees, flexible repayment. One common example is a Federal Housing Administration (FHA) loan, which helps low income individuals buy a home or refinance a mortgage. However, some private.

How To Lock Your Credit Information

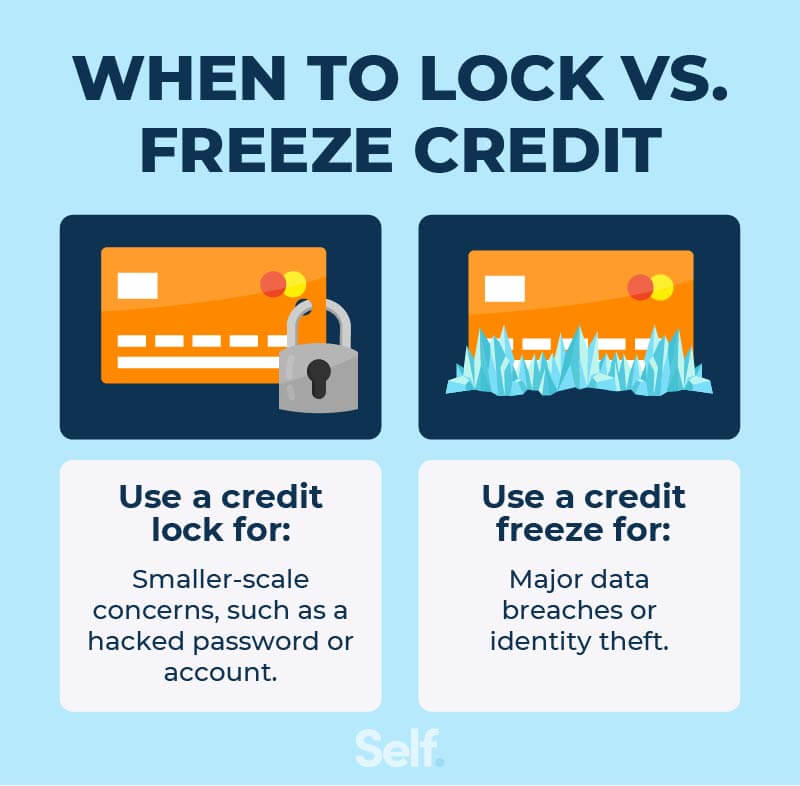

Having a freeze on your credit report will not affect your credit scores, but it may prevent your credit report from being accessed until you unfreeze your. Yes, you can freeze your credit online, but you'll need to contact all three credit bureaus: Equifax®, Experian™ and TransUnion®, to do so. You can contact each. If you're freezing or thawing your credit reports online, you'll simply need to log in to your accounts and go to the credit freeze management center. However. You have two primary options for freezing your credit files with the three major credit bureaus. You can do it by phone or online, whichever you're more. Credit locks have no impact on your credit score. · It may require monthly charges. · It does not exclude you from obtaining your free yearly credit report. · It. Equifax: Equifax says you can freeze your credit by creating an account online, calling , or completing and returning its security freeze request. With Lock & Alert, you can quickly lock or unlock your Equifax credit report online or via the mobile app. There are no fees to lock or unlock your Equifax. How To Lock Your Credit · Equifax Lock & Alert. This program lets you control your Equifax credit report and files for free. · TransUnion TrueIdentity. You can. How to Lock Your Credit. If you want to lock your credit, you can do so by signing up for a credit locking service with one or all of the major credit bureaus. Having a freeze on your credit report will not affect your credit scores, but it may prevent your credit report from being accessed until you unfreeze your. Yes, you can freeze your credit online, but you'll need to contact all three credit bureaus: Equifax®, Experian™ and TransUnion®, to do so. You can contact each. If you're freezing or thawing your credit reports online, you'll simply need to log in to your accounts and go to the credit freeze management center. However. You have two primary options for freezing your credit files with the three major credit bureaus. You can do it by phone or online, whichever you're more. Credit locks have no impact on your credit score. · It may require monthly charges. · It does not exclude you from obtaining your free yearly credit report. · It. Equifax: Equifax says you can freeze your credit by creating an account online, calling , or completing and returning its security freeze request. With Lock & Alert, you can quickly lock or unlock your Equifax credit report online or via the mobile app. There are no fees to lock or unlock your Equifax. How To Lock Your Credit · Equifax Lock & Alert. This program lets you control your Equifax credit report and files for free. · TransUnion TrueIdentity. You can. How to Lock Your Credit. If you want to lock your credit, you can do so by signing up for a credit locking service with one or all of the major credit bureaus.

Online: Sign up online to freeze and unfreeze your credit. · By phone: EXPERIAN () · By mail: Send your request to Experian Security Freeze. How Do I Actually Freeze My Credit? · 1. Gather your information · 2. Contact each credit agency · 3. Save your passwords. You have two primary options for freezing your credit files with the three major credit bureaus. You can do it by phone or online, whichever you're more. How to Freeze Your Credit. If you want to freeze your credit you can do so by contacting each of the three major credit bureaus. Here's how to reach them. You can also manage your freeze by phone: call us at () You'll be required to give certain information to verify your identity. You'll also have. If your credit files are frozen, even someone who has your name and Social Security number might not be able to get credit in your name. Maryland consumers may. There is no cost to freeze or unfreeze your credit report. How to turn on the Credit Freeze: Contact each of the three major credit bureaus indicating your wish. Who can place one: Anyone can freeze their credit report, even if their identity has not been stolen. What it does: A credit freeze restricts access to your. You can lift it for a period of time, or you can lift it for a specific creditor, or you can lift it permanently. After you send your letter asking for the. A security freeze means that your credit file cannot be shared with potential creditors. A security freeze can help prevent identity theft, because most. Contact the Credit Bureaus to Request a Security Freeze · Equifax PO Box Atlanta, GA · Experian PO Box Allen, TX A credit freeze, also called a security freeze, prevents a credit reporting agency from releasing your credit report to others, without affecting your. A credit freeze keeps new creditors from accessing your credit report without your permission. information, because creditors cannot access your credit report. The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by. A credit freeze locks your credit report until you approve its release—making it harder for identity thieves to open new credit accounts in your name. If you've. thieves from opening fraudulent accounts. • A credit freeze is the best tool to restrict access to your credit report.» This. A security freeze can help protect against identity theft. What do the credit reporting agencies charge? Placing a. Freeze. Temporary. Lift. Credit locks have no impact on your credit score. · It may require monthly charges. · It does not exclude you from obtaining your free yearly credit report. · It. Does freezing my file mean that I won't receive pre-approved credit offers? No. You can stop the pre-approved credit offers by calling OPTOUT (). The process to place a security freeze requires that you directly contact each of the credit reporting companies. You can do so online or through the mail.

Refinance Underwater Car Loan

Calculate Negative Equity · Contact Your Lender · Continue Making Payments · Make as Many Payments as Possible · Refinancing an Upside-Down Loan · Selling Your. When the amount you owe on your auto loan is greater than the vehicle's value, you have a negative equity car loan. Many people refer to it as being upside down. It's possible to refinance a car loan when you're upside down if you can find a lender who's willing to approve you. Lenders can consider the value of the. “Underwater” Loans: The balance on an “underwater” loan is greater than the value of the vehicle, in which case refinancing probably isn't an option. How to. 1. Calculate Negative Equity: · 2. Contact Your Lender: · 3. Continue Making Payments: · 4. Make as Many Payments as Possible: · 5. Refinancing an Upside-Down Loan. Wanna get out of your upside down auto loan? Try refinancing. With hangofranking.ru, you get the best refinance options available to you. Use our refinance loan. Make additional cash payments to get out of the water. Seriously. Underwater is easy to see coming. People borrow money because the want. 1. Refinance Your Auto Loan Just like a mortgage, you can refinance your car loan to get a shorter repayment period or a lower interest rate, both of which. Refinance Your Vehicle – refinancing is one of the most popular options vehicle owners choose when looking to get out of an underwater car loan. Depending. Calculate Negative Equity · Contact Your Lender · Continue Making Payments · Make as Many Payments as Possible · Refinancing an Upside-Down Loan · Selling Your. When the amount you owe on your auto loan is greater than the vehicle's value, you have a negative equity car loan. Many people refer to it as being upside down. It's possible to refinance a car loan when you're upside down if you can find a lender who's willing to approve you. Lenders can consider the value of the. “Underwater” Loans: The balance on an “underwater” loan is greater than the value of the vehicle, in which case refinancing probably isn't an option. How to. 1. Calculate Negative Equity: · 2. Contact Your Lender: · 3. Continue Making Payments: · 4. Make as Many Payments as Possible: · 5. Refinancing an Upside-Down Loan. Wanna get out of your upside down auto loan? Try refinancing. With hangofranking.ru, you get the best refinance options available to you. Use our refinance loan. Make additional cash payments to get out of the water. Seriously. Underwater is easy to see coming. People borrow money because the want. 1. Refinance Your Auto Loan Just like a mortgage, you can refinance your car loan to get a shorter repayment period or a lower interest rate, both of which. Refinance Your Vehicle – refinancing is one of the most popular options vehicle owners choose when looking to get out of an underwater car loan. Depending.

If you're upside-down and refinance your car, you might end up borrowing more than the car's worth. This can lead to higher interest costs over the life of the. Fees or Penalties: Make sure that your original car loan doesn't include any fees or penalties associated with paying it off early. · Underwater Finances: Being. Underwater Finances: Does the value of what you owe on your loan exceed your vehicle's current book value? If so, it can be harder to get approved for. Also known as being “upside-down” or “underwater,” it means the amount left on your car loan is more than your car's value. Lenders typically avoid refinancing. The only way to refinance would be if you come up with the difference between what you owe on the car and what the car is worth. However this. By refinancing your auto loan, you can choose to modify your loan term into a shorter one. This can help you get out of an underwater loan since you'll pay more. What to Know When Refinancing Your Car · Fees: Check your original car loan agreement to ensure there are no pre-payment fees. · Underwater Finances: If you owe. Another viable option is to refinance your loan for a lower interest rate and payment. There are lenders for all manner of credit, but ideally, you will want. Hidden Fees: Refinancing your car often means that you pay your car loan early. · Underwater Finances: When you owe more on your car than its currently worth. Underwater Loans: A vehicle loan is “underwater” when the balance on the loan is higher than the worth of the vehicle. These kinds of loans are unlikely. Yes, you can refinance an upside down car loan, but it can be challenging. It may come with higher interest rates or require additional collateral. If you're. Refinancing your auto loan may be the best way to get a more affordable payment and possibly get rid of the balance much faster than you would with the original. When you owe more on a vehicle than the vehicle can be sold for this is called underwater, and you only have a few options to say goodbye to that loan, most of. Underwater Finances: Does the value of what you owe on your loan exceed your vehicle's current book value? If so, it can be harder to get approved for. What to Know When Refinancing Your Car · Prepayment Penalties: Check for any early payment penalties on your current loan. · Underwater Loans: If the amount you. Negative equity auto loans happen when a buyer takes out a loan with some very attractive long-term loan financing terms. But due to the loan's additional. Hidden Fees: Refinancing your car often means that you pay your car loan early. · Underwater Finances: When you owe more on your car than its currently worth. 1. Refinance if Possible · 2. Move the Excess Car Debt to a Credit Line · 3. Sell Some Stuff · 4. Get a Part-Time Job. Combined with higher loan amounts and longer terms, that depreciation can put you underwater – meaning you owe more than your vehicle is worth. When underwater. You can do this by trading in your current vehicle and getting a new auto loan that includes your negative equity. This means you'll start off upside-down on.

Asset Backed Securities Example

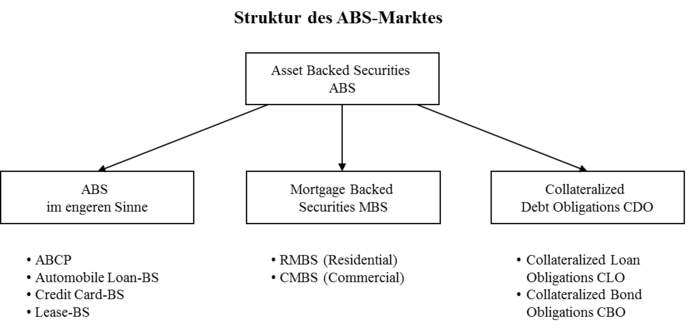

Asset Securitization. 5 sheets. For example, because a market exists for mortgage-backed securities, lenders can now extend fixed rate debt, which many. Generally, asset-backed securities are created by lenders that wish to convert balance sheet assets, such as receivables or loans, into a tradable security. The. Asset-backed securities are essentially pools of smaller assets held by various financial institutions, such as banks, credit unions, and other lenders. Most of. Table 1: Example of Asset Portfolio Scheduled Amortisation. Period. Loan 1. Loan 2. Loan 3. Total Portfolio. 0. 1. Home equity loans · Auto loans · Credit card receivables · Student loans · Stranded cost utilities · Others. For the purpose of this primer, consumer asset-backed securities (ABS) are structured finance securities collateralized by pools of auto loans and leases. For example, an issuer of single family housing bonds or student loan bonds is likely a municipal securitizer for purposes of SEC Rule 15Ga-1 because these. Asset-backed securities (ABS) are a type of bond, typically issued by banks or other lenders. What makes ABS different to conventional bonds. Asset-backed securities are debt securities that have interest, and principal payments that are backed by underlying cash flows from other assets such as first. Asset Securitization. 5 sheets. For example, because a market exists for mortgage-backed securities, lenders can now extend fixed rate debt, which many. Generally, asset-backed securities are created by lenders that wish to convert balance sheet assets, such as receivables or loans, into a tradable security. The. Asset-backed securities are essentially pools of smaller assets held by various financial institutions, such as banks, credit unions, and other lenders. Most of. Table 1: Example of Asset Portfolio Scheduled Amortisation. Period. Loan 1. Loan 2. Loan 3. Total Portfolio. 0. 1. Home equity loans · Auto loans · Credit card receivables · Student loans · Stranded cost utilities · Others. For the purpose of this primer, consumer asset-backed securities (ABS) are structured finance securities collateralized by pools of auto loans and leases. For example, an issuer of single family housing bonds or student loan bonds is likely a municipal securitizer for purposes of SEC Rule 15Ga-1 because these. Asset-backed securities (ABS) are a type of bond, typically issued by banks or other lenders. What makes ABS different to conventional bonds. Asset-backed securities are debt securities that have interest, and principal payments that are backed by underlying cash flows from other assets such as first.

Asset-backed securities (ABS) have underlying assets, which are loan pools securitised by issuers and then sold to third-party investors. Banks are originators. The first four asset types listed below—home-equity loans, auto loans, credit cards and student loans—together constitute the largest segment of the ABS market. For example, a pension fund with a long-term horizon can gain access to long-term real estate loans by investing in residential MBS without having to invest in. Asset-backed securities are essentially pools of smaller assets held by various financial institutions, such as banks, credit unions, and other lenders. Asset-backed securities (ABS) finance pools of familiar asset types, such as auto loans, aircraft leases, credit card receivables, mortgages, and business. Asset-backed securities (ABS) finance pools of familiar asset types, such as auto loans, aircraft leases, credit card receivables, mortgages, and business. Credit card asset-backed securities (ABS) are fixed income bonds that are backed by the cash flow from credit cards. For example, if the vehicle or SPV buys mortgage loans from banks, the ABS will be transformed into MBS or Mortgage Backed Securities, whether they are. This section reviews the development of the ABS market in the last two decades, which has been bumpy. It is an example of the unique financial development path. Examples of amortizing loans backing an ABS: mortgage loans and automobile loans. An example of non-amortizing loans backing an ABS: credit card receivables. ABS - Asset Backed Securities · AGCY - Agency Bonds · CHRC - Church Bonds · CORP - Corporate Bonds · ELN - Equity Linked Notes · MBS - Mortgage Backed Securities. Asset-backed securities are produced when a lender lends money to a borrower and sells the loan to an investor. The borrower then pays the investor regularly. An asset backed security is essentially an investment instrument that is supported by a physical thing. For example a mortgage backed security is an asset. Asset Backed Securities (ABS) are financial securities backed by income-producing assets such as car loans, credit card loans, or business loans. They are used. Asset-backed securities are bonds that are based on underlying pools of assets. A special purpose trust or instrument is set up which takes title to the. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateralized debt. This is called securitisation. A typical example is the mortgage-backed security. Let's look at that a little more closely. In this example, Omega Investments. ABS and. ABS issuers, which have several distinguishing characteristics compared to other fixed income securities and their issuers. For example, the issuing. The term mortgage-backed security (MBS) is commonly used for securities which are backed by high quality real estate mortgages. The term “asset-backed. From mortgage loan providers to leading financial institutions, we have supported issuers of varying industries in listing all types of ABS, including leading.

The Best Thing To Sell

Best Things to Sell on eBay · 1. Tennis shoes. Tennis shoes are one of my favorite things to sell. · 2. Bobbleheads. Bobbleheads are another one of my. One of the original online marketplaces, Craigslist (hangofranking.ru), is where you can sell used things. You can list all sorts of things, from tools to toys. 20 Best Things to Sell to Start a Business · Art and Other Digital Products. These are 18 incredibly easy things to make and sell for extra money online. Featuring Etsy, Google & Pinterest best-selling DIY & craft trends. Authentic vintage and designer jewelry can be quite valuable, especially if it is in good condition. Earrings, rings, necklaces, and brooches that have precious. 10 Best Things To Sell on eBay in Best Things To Sell On eBay · Used Cell Phones · Luxury Watches · Toys And Action Figures · Computer Accessories · Baby Items · Collectibles · Sports Cards. Printables. Printables are some of the easiest and most profitable types of Etsy listings. · eBooks. Selling an eBook on Etsy is another great. Best Things To Sell On eBay · Used Cell Phones · Luxury Watches · Toys And Action Figures · Computer Accessories · Baby Items · Collectibles · Sports Cards. Best Things to Sell on eBay · 1. Tennis shoes. Tennis shoes are one of my favorite things to sell. · 2. Bobbleheads. Bobbleheads are another one of my. One of the original online marketplaces, Craigslist (hangofranking.ru), is where you can sell used things. You can list all sorts of things, from tools to toys. 20 Best Things to Sell to Start a Business · Art and Other Digital Products. These are 18 incredibly easy things to make and sell for extra money online. Featuring Etsy, Google & Pinterest best-selling DIY & craft trends. Authentic vintage and designer jewelry can be quite valuable, especially if it is in good condition. Earrings, rings, necklaces, and brooches that have precious. 10 Best Things To Sell on eBay in Best Things To Sell On eBay · Used Cell Phones · Luxury Watches · Toys And Action Figures · Computer Accessories · Baby Items · Collectibles · Sports Cards. Printables. Printables are some of the easiest and most profitable types of Etsy listings. · eBooks. Selling an eBook on Etsy is another great. Best Things To Sell On eBay · Used Cell Phones · Luxury Watches · Toys And Action Figures · Computer Accessories · Baby Items · Collectibles · Sports Cards.

These sell out every single time they're listed! I'd say it's hands down one of the BEST ITEMS TO RESELL for profit. This works best if it's a brand name. Discover the best in Best Sellers. Find the top most popular items in Amazon Best Sellers Sell products on Amazon · Recalls and Product Safety Alerts. The 16 Best Things to Sell Online · 1. Antiques and Vintage Items · 2. Art · 3. Books · 4. CDs, Records, Video Games and Other Media · 5. Cell Phones and. The Top Ten Grossing Products and Brands on eBay · 1) Laptops & Netbooks – £ million · 2) Watches – £ million · 3) Women's Dresses – £82 million · 4). 1. Personal hygiene products · 2. Household cleaning supplies · 3. Basic clothing items. 4. Food staples. 5. Smartphone accessories. 6. Health and. This category sees a huge increase in sales during the holiday season. There is always a good, ever-growing demand for this category because of the. If you have old kid's toys at home, this is one of the best things to sell to make quick cash. You can sell toys, action figures, video games, puzzles. I would recommend finding a niche item that's not already being sold by eight zillion others, and go with that instead. Being the best seller in a niche market. Selling cute stuffed animals is a great way to raise money, especially for nonprofits that help animals. These are also great to sell for fundraising during. What can I sell to make money fast? Some of the best things to sell to make money fast are: Old clothes; Jewelries; DIYs and handmade goods; Home decors; '. Furthermore, various accessories such as a motorcycle helmet or jewelry are items which, if in good condition, guarantee an easy income. Very interesting about. Brands like Nike, Lululemon, Under Armour, and Athleta are just a few examples of popular athletic brands that sell pretty well on Mercari. In addition. Want to build an effective fundraising campaign? · 1. Gourmet Popcorn. Popcorns are a popular treat hence, easier to sell. · 2. Discount Cards. You can sell. Best-selling items on Etsy typically include personalized gifts, handmade jewelry, and unique home decor pieces. These categories consistently attract buyers. Homemade cookies with a variety of flavours and fewer calories will be the best option to sell. . Baby dress. A baby is sitting on the sofa wearing. These are questions I was asking myself not too long ago, until I encountered Sarah Titus' course. Besides sharing proven tips about the best products to sell. What Can You Sell At Festivals? · Sunscreen · Bug repellant · Umbrellas · Rain jackets/ponchos · Blankets · Towels · Lawn chairs · Coolers; Thermos/to-go mugs. Books are a great thing to sell for extra money. Depending on exactly what you are selling, you may be able to earn a couple hundred dollars from a stack of. The Best Things To Sell On Facebook Marketplace · The best things to sell on Facebook Marketplace include furniture, toys, clothing lots and tools. · Smaller.

Which Bank Is Best For Joint Account

While a joint account acts like a traditional individual savings account, the difference is that it's shared by two or more people. It's not a credit product. Simplify your family finances with a joint bank account from Zeta. Explore the benefits of our joint banking solutions designed for couples and families. A joint bank account can be beneficial for couples. Learn what a joint account is with this article from Better Money Habits. A joint savings account from Santander can help you reach shared financial goals. Learn more about the benefits and how to open a joint savings account. We outline the benefits of both joint and separate accounts for couples to help you decide what's best for you. A joint savings account from Santander can help you reach shared financial goals. Learn more about the benefits and how to open a joint savings account. When you're ready to open a joint bank account, visit a TD Bank with your co-owner to get started. 7 reasons why separate accounts are good for your marriage. Posted by accounts and share a joint bank account. My husband and I have realized that. A no-fee joint bank account offers the same benefits of a joint bank account without expensive monthly fees. While a joint account acts like a traditional individual savings account, the difference is that it's shared by two or more people. It's not a credit product. Simplify your family finances with a joint bank account from Zeta. Explore the benefits of our joint banking solutions designed for couples and families. A joint bank account can be beneficial for couples. Learn what a joint account is with this article from Better Money Habits. A joint savings account from Santander can help you reach shared financial goals. Learn more about the benefits and how to open a joint savings account. We outline the benefits of both joint and separate accounts for couples to help you decide what's best for you. A joint savings account from Santander can help you reach shared financial goals. Learn more about the benefits and how to open a joint savings account. When you're ready to open a joint bank account, visit a TD Bank with your co-owner to get started. 7 reasons why separate accounts are good for your marriage. Posted by accounts and share a joint bank account. My husband and I have realized that. A no-fee joint bank account offers the same benefits of a joint bank account without expensive monthly fees.

A joint account is a bank or brokerage account shared between two or more individuals. Joint accounts are most likely to be used by relatives, couples, or. All our accounts can be opened jointly. Simply select the Joint option when applying. Learn what you'll need to apply online. Zeta Accounts are spending & saving bank accounts designed to grow with you. When you sign up, you get one joint bank account, two debit cards, and a mobile app. A joint bank account usually refers to a checking or savings account shared by two or more individuals. The account's defining feature is the equal financial. Best joint bank accounts · Best for checking/savings combo: SoFi Checking and Savings · Best savings account: LendingClub LevelUp Savings · Best from a major. In most cases, banks and other financial institutions add an individual to an account as a joint owner, not an authorized signer. Assets that were managed. If you haven't considered opening a joint account to manage shared finances, it might be a good option for you under certain circumstances. Joint bank accounts. The main benefit of a joint bank account is that it makes your financial life easier. You can reduce the time, cost and hassle of paying bills by sharing. Simplify your family finances with a joint bank account from Zeta. Explore the benefits of our joint banking solutions designed for couples and families. Joint account cards. Why a joint bank account may be best for you? A joint bank account is simply a type of account that gives equal access to two people. In addition to most Canadian accounts or RBC US High Interest eSavings®, you can also open a joint US Personal account® in Online Banking. Best of all. Speak with your financial institution about your wishes so they can assist you with a financial product that best suits your needs. Many Canadians are concerned. Personal joint bank accounts are more standardized and function just like an individual checking account. · Joint savings accounts are a great way to maximize. If you haven't considered opening a joint account to manage shared finances, it might be a good option for you under certain circumstances. Joint bank accounts. best for you. What information do I need to open a joint account? You'll need the same information that's needed when opening an individual account, but you. What are the alternatives to a joint savings account? · Use a specialised card. Some specialist cards allow others to spend on your behalf while you stay in. A joint bank account is a great way to manage shared finances with a partner, spouse, or parent. Banking together has never been easier with a joint account. Not sure which checking account is the best fit? Compare all checking How do I open a joint checking account? Joint checking accounts must be. Joint bank accounts can make money matters simpler and more convenient for everyday life. Plus, having two sets of eyes on the account can mean more frequent. Not sure which checking account is the best fit? Compare all checking How do I open a joint checking account? Joint checking accounts must be.